Small business owners are multi-taskers – with a host of responsibilities on their plate.

To make life easier, consider investing in an automated payroll system. There are a range of payroll companies on the market – for businesses of all sizes. They provide support in filing taxes, creating accurate invoices, direct debits and more.

Setting aside a budget for HRIS will save you time – so you can direct more energy towards supporting your teams.

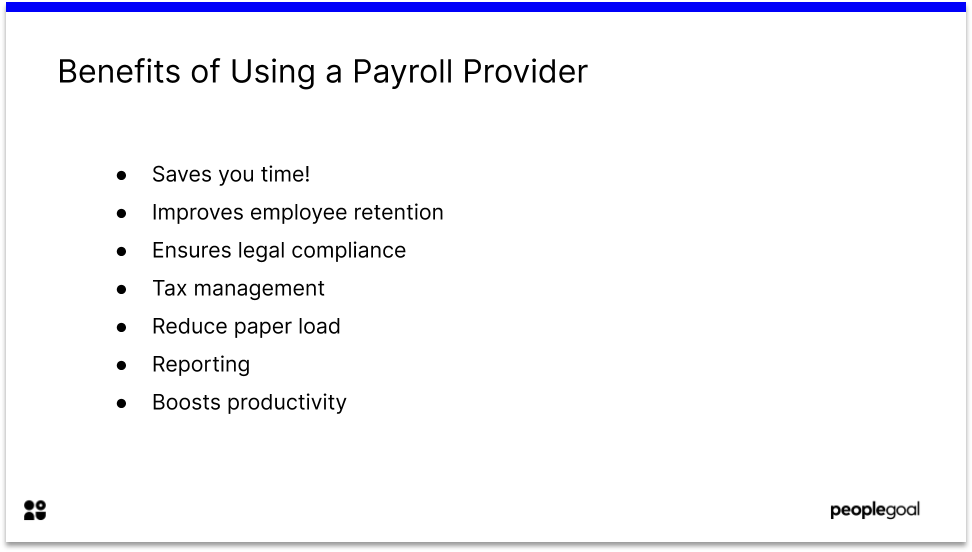

Benefits of a Payroll Provider

-

Saves you time!

-

Improves employee retention by ensuring employees are paid on time and accurately

-

Ensures legal compliance

-

Tax management

-

Reduce paper load

-

Reporting to track employee absenteeism, staffing costs, and more

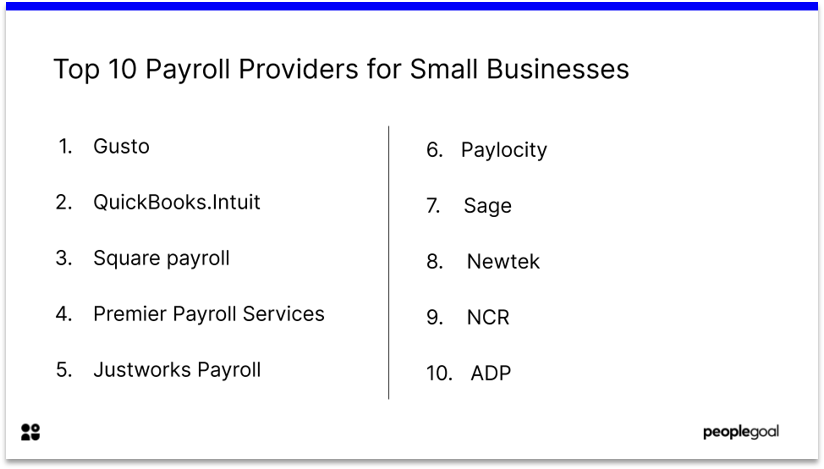

1. Gusto

Gusto provides a full-service payroll software to minimize your paperload. They offer extensive support for complex benefit schemes, and keep private information secure in an online vault.

Gusto payroll automatically files payroll taxes with government agencies. It allows you to easily track time off and overtime, helping you to improve employee wellbeing.

Their knowledgeable support team keep track of compliance laws – so that you can fully support your teams. They help onboard employees so that everyone knows how to use the system.

Gusto Key Features

-

Synced on one platform, integrations with QuickBooks, Xero and more

-

Stores Employee I-9s and W-2s, and contractor 1099s

-

Keeps track of compliance

-

Time tracking for lunch breaks, leave, etc.

-

Simple onboarding

-

Mobile app

-

GustoWallet for employees

-

Paperless

We really do consider Gusto to be a key business partner. We rely on their expert payroll, tax, and compliance advice from their awesome, helpful support team and Help Center articles. – Amneet Bhurji, Finance Manager, Student Loan Hero

2. QuickBooks.Intuit

QuickBooks’ Standard Payroll gives staff access to pay slips via QuickBooks workforce.

In Advanced Payroll, in addition to viewing payslips, employees can request paid time-off, upload timesheets and expenses and much more.

QuickBooks automates payroll, pension contributions, overtime and more to save you time at the end of the month! Advanced Payroll makes this process even simpler, giving managers more time to engage employees and respond to clients.

QuickBooks Payroll also offers a great reporting feature – so you can review time and attendance and staffing costs in an intuitive way.

Customer service is a major pull of QuickBooks – they offer unlimited free support for UK-based clients, via phone, chat or video call.

QuickBooks.Intuit Key Features

-

24/hr Support

-

GDPR compliant

-

Reporting on leave requests, rotas and more

-

CIS deductions for construction teams

-

Quick implementation

3. Square payroll

Square automatically files federal, state and local taxes to ensure compliance. They are small-business focused and specialize in both internal revenue and social security administration.

You can customize pay schedules and integrate with QuickBooks. Square’s time-tracking software will save you time, and ensure no-one goes underpaid.

Square Balance means you can pay employees instantly – without having to wait for the bank to process funds.

They offer support during onboarding and are available over phone and email during businesses hours.

You can set up a Square payroll account for free to see how the user interface works.

Square payroll key features

-

Free set-up to view product

-

Ensure compliance

-

Reporting

-

Integration with QuickBooks, Square Point, and others

-

Only pay for what you use

-

Benefits tab on dashboard

-

Time and attendance measuring

-

Dashboard app for mobile

You don’t need five different systems to run a business. With Square, it’s all in one which makes it easy—and it’s affordable!, Heli Prilliman, Owner, Lacquerbar

4. Premier Payroll Services

Premier Payroll Services aim to reduce your payroll stress! Its system is self-service, so employees can check their pay checks seamlessly.

Premier Payroll has been in this space for 20 years, and clients are impressed with the customer service on offer.

They use the national software vendor iSolved to keep your information secure.

Premier Payroll Services Key Features

-

Employee self service

-

Secure system

-

Direct deposits

-

Organize quarterly tax

-

Garnishments

-

Onboarding

-

Access wherever you have internet

-

401ks

Premier Payroll Services delivers the personal touch that was lacking from our national payroll service provider. We can’t put a price tag on the value of payroll services in our own backyard since 2003 and knowing the owners are a phone call away. – Timothy B. Rimmer, PMA Medical Specialists, LLC

5. Justworks Payroll

Justworks integrates payroll with benefits administration – so it’s a great solution if you need access to both areas. They provide a Basic and Plus Payroll program. Plus provides access to medical, dental and vision insurance, in addition to HR consultancy, payroll and other services.

Justworks Basic offers medical benefits for your teams, as well as organizing payroll, taxes, compliance and much more.

They provide great onboarding support – so your new hires are set up and ready-to-go quickly. Their customer service team is excellent – and available 24/7.

Justworks Key Features

-

Includes employee benefits programs

-

HR consultancy

-

24/7 support

-

Off-cycle payroll at no extra cost

-

Automates tax deductions

Everyone loves how easy it is…Justworks has freed our team from administrative headaches and allowed us to focus on our core mission. – Kayla Brown, Chief of Staff at Axios

6. Paylocity

Paylocity’s payroll software works on desktop and mobile, and is great for flexibility. You can easily organize advances for employees.

In addition to payroll, they offer support on expenses, on demand payment, tax and wage garnishment.

You can preview your pay checks before they are sent out, and edit as required.

Paylocity faces up to the realities of small business salaries – allowing you the flexibility to reward staff for their hard work.

Paylocity can automatically transfer 401k data and benefits files to ensure an easy renumeration process.

Their data insights are best-in-class, and give you the reporting you need to make strategic employment and budgeting choices.

Paylocity Key Features

-

Mobile friendly

-

Reporting to analyze employee retention and other metrics

-

Expert tax management

-

Small business specific services

-

Integrations

-

Give employees resources to find information they need, saving managers time

-

Resource library

Paylocity is the best!! If you want a platform that is easy to use, this is the product for you., Melissa Richards, Treasurer, CST Co.

7. Sage

Sage has the highest customer retention rate in this space. Your pay checks can be customized, or you can use one of their ready-to-go templates.

Sage takes a self-service approach, using Saas cloud technology. Use the platform for time tracking, medical leave and annual leave. Sage enables you to file taxes securely, and ensures legal compliance.

You can make the onboarding process smoother and impress your new hires with their online I-9 Form. This helps you optimize payroll right from the beginning of the employee life-cycle.

Sage HRMS Time and Labor Import by Delphia Consulting is a great feature – which enables you to validate and import data from almost any data source into the Sage HRMS Payroll timecard file.

Sage University offers you the tips and tricks to use the software like a pro.

Sage Key Features

-

Easy integrations

-

Tax and legal compliance

-

Employee onboarding support

-

Sage HRMS Time and Labor Import

-

Time tracking

-

I-9 Forms

8. Newtek

Newtek is less expensive, and just as high-quality, as some of its competitors.

It offers payroll processing and time and labor management through its cloud-based system. They take all liability for accuracy of payroll taxes, so you can rest assured.

You can manage your account from any device with an internet connection. Employee pay-stubs are available for employees and managers to view online.

Their services can be tailored to your companies needs and budget. Their customer support team will help you deliver your first payroll on the system.

One of Newtek’s strengths is its security. They create automatic backups, redundancies and disaster recovery protocols to ensure your information is confidential and secure.

Newtek Key Features

-

Great security

-

Cloud-based

-

Assisted Payroll enrolment

-

Tax management

-

401ks and worker compensation

-

Direct deposit or self-print checks

-

Unlimited direct deposits

-

Single Point of Contact support

-

‘A la carte’ or flexible service

9. NCR

NCR’s Payroll service ensures quick turnaround for employee payments. As well as a range of HR tools, they offer great tax filing, to reduce your paperwork burden.

Their system allows for easy self-service, so employees can submit changes or items for review. This addresses the problem that with complex benefits programs, payrolls often need editing.

With NCR, your business gets a dedicated representative to talk you through the process.

The NCR Money Access Card is another option if you’re looking for payroll solutions. It works like a traditional bank account and eliminates paper and processing fees.

NCR Payroll Key Features

-

Single point of contact support

-

Self-service

-

Quick turnaround

-

Tax filing

-

NCR Money Acess Card with 24/7 support

10. ADP

ADP’s Small Business Payroll allows you to process payroll in minutes. Taxes are deducted and paid automatically – ensuring compliance.

ADP offers 24/7 support for any queries. They can provide quarterly and annual reporting, saving you time to take care of your business!

ADP’s payroll for companies with less than 10 employees allows you to set up an account in just 20 minutes.

Their payroll dashboard creates a To Do list to ensure that all tasks are ticked off. This is a great option for a small business looking for an all-inclusive monthly subscription.

ADP Key Features

-

Reporting

-

Legal compliance

-

24/7 support

-

Clear and easy to use dashboard

-

Monthly subscription

-

Quarterly and annual reports

As a small business we operate in 5 or 6 different states…so there are a lot of requirements for filing taxes in each one. ADP does an excellent job of helping us maintain that. – Kevin Jennings, President & CEO Millenium Corporation

A better payroll provider is just the start

Payroll is just one aspect of HRIS. As a small-business leader, you can optimize efficiency by improving core HR, time tracking and more.

Our PeopleGoal app store provides myriad ways to save on the paperwork, and keep track of employee information. Our Support Article on Absence requests is just one way PeopleGoal can support your company.

Ready to 3x Your Teams' Performance?

Use the best performance management software to align goals, track progress, and boost employee engagement.