New employee forms are a crucial step in the onboarding process of new hires. These forms contain important information that can either be federal and state forms, which are required by law or standard new hire forms, which are specific to your business. To ensure your new hire completes the appropriate forms for your state check your local labor regulations.

When should new Employee Forms be completed?

It is advised to have your remote new hire fill out forms and paperwork before their start date to allow them to focus from day one. The use of electronic signature (e-signature) allows remote hires to sign contracts and any other paperwork digitally.

The Human Resources department will then securely store these in their physical and/or digital form as they contain confidential data.

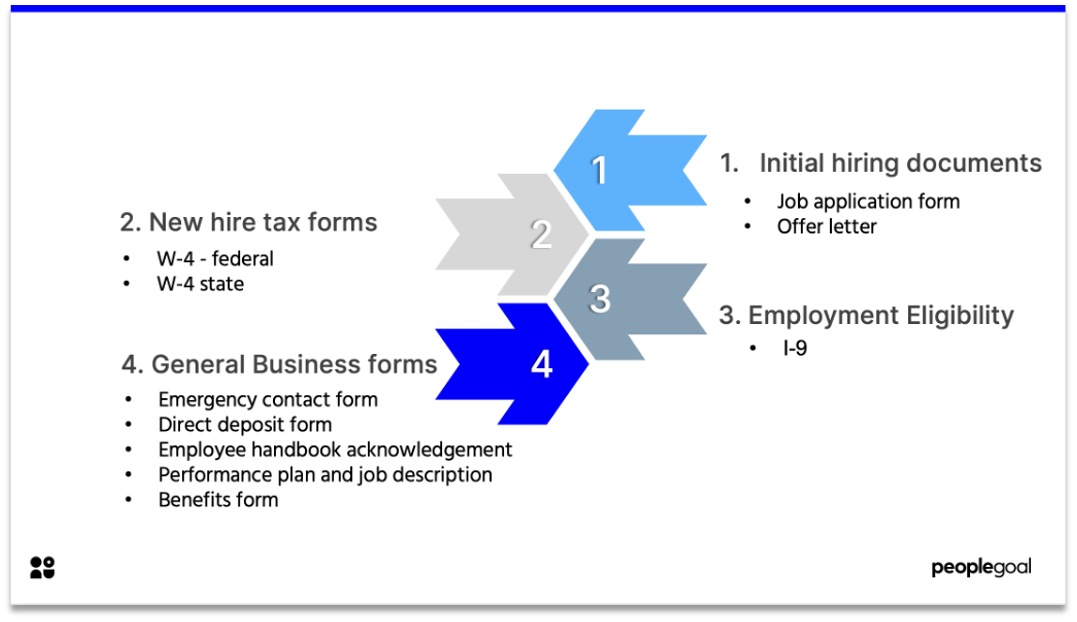

What are the different types new Employee Forms?

There are four broad categories of new employee forms which your employee should complete.

- Initial Hiring Documents

- New Hire Tax forms

- Employment Eligibility

- General Business Forms

Use this following guide of the top 10 most used new employee forms to find the most suitable one for you.

💡Tip: The hiring process can be a confusing time, read our How to Write a New Hire Checklist to personalise and simplify this process!

The 10 most used new Employee Forms

1. Initial Hiring Documents 🏁

The onboarding process always begins with a job offer. The following forms allow this process to begin.

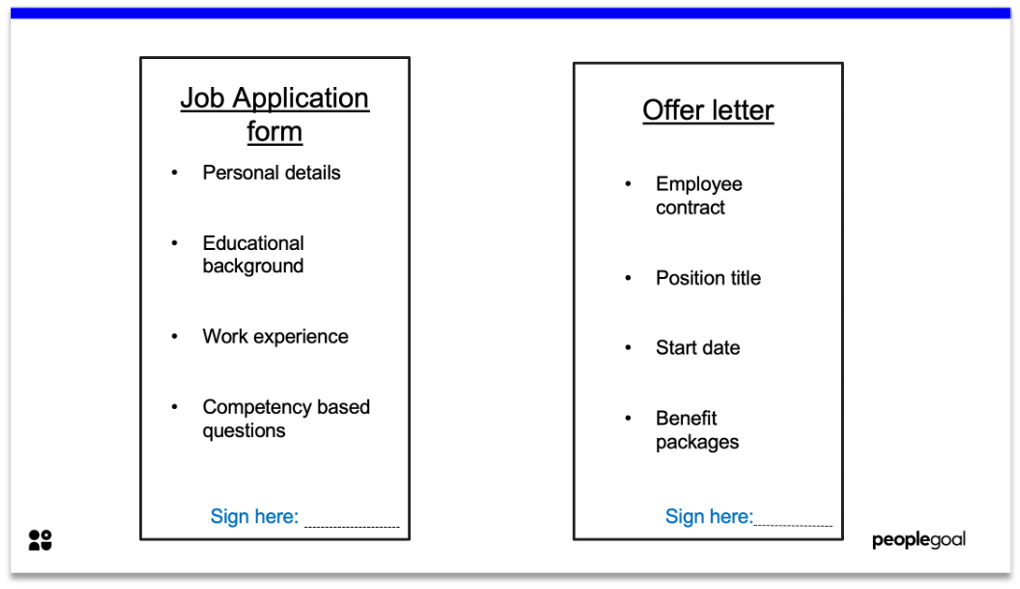

Job application form

This is the first official document required for onboarding. This contains all the initial crucial information such as:

- Personal information – basic details, such as their name and email address.

- Educational background

- Work experience – list of employment history and the main duties involved

- Competency-based questions – can be specified to your business

New employees should sign to confirm all the information is correct and consent to background checking.

Retention: Three years after start date

Offer letter

This is the letter sent out by your company detailing the position of employment to the new hire. This can also contain their employee contract. it covers important details of the terms of employment including position title, start date and any benefits included. This will be signed and returned to the employer.

This can also contain the company’s drug testing policy if it is relevant.

Retention: At least three years after termination

2. New hire Tax forms 🧾

This is the form that states how much of a new hires earnings need to be deducted for income tax.

W-4

This is the employees withholding certificate and is required by the IRS. The new hires paperwork is then used to calculate how much federal income tax is withheld dependent on the information provided by the employee as it can be decreased, increased or even exempt in certain situations. It is important to bare in mind the IRS has completely changed their W-4 forms in 2020.

After the form is complete use the IRS Publication 15 to calculate the amount of taxes to withhold.

Find an example of a W-4 form here 👈

Retention: At least four years after their tax is due or paid.

State W-4

If your business is located in a state which collects state tax, a State W-4 will need to be filled out. Like the federal tax form, this takes into account the personal details of the employee to calculate a set amount of income tax withholding.

This is specific to certain states and some – like California – have a DE-4 Withholding Certificate.

Some areas also have a local income tax, however, these are not determined by a withholding form.

3. Employment Eligibility 🟩

As an employer, you are legally responsible to confirm whether an employee is eligible to work in the United States of America.

Form I-9

Form I-9 employment eligibility verification requires both employer and employees to fill out parts of the document. New hires must do so on their first day of employment. Further steps of this form require documentation to prove their identities such as drivers licence, social security card or social security number and passports.

Here is a list of acceptable documentation 👈

Retention: Three years after the date of hire or one year after their employment date ends.

4. Business Forms 👩🏽💼

These are the standard new hire forms that can be specific to your business. These forms prepare your remote new hire with the information relevant to begin their new role. They cover payroll to performance plans.

Emergency Contact Form

This is the information required in case of an accident or emergency at work. Most contain two to three emergency contacts information such as; name, relationship to the employee, home and mobile number.

It is advised to use contacts located close to your business.

Direct Deposit Authorisation

Direct deposit is usually the most convenient method of payment for both parties. This form will contain all the information to begin paying their wage, including:

- Employee name

- Type of account (checking or savings)

- Name and routing number of the bank

- Employee’s bank account number

Once this agreement has been signed and the employee’s bank account is on the system they can be added to the payroll.

💡Tip: (for small businesses) we know how hard it is to juggle the range of HRIS responsibilities, so we have found the Top 10 Payroll providers for you 👈

Retention: At least four years after termination

Benefits form

This is only relevant if this business offers benefits packages. Employees must either opt-in or out of the benefits offered by completing these forms.

Some examples of these are:

- Health insurance

- Retirement plans

- Life insurance

Retention: At least three years after termination

Employee Handbook Acknowledgement form **

If your company has an employee handbook it is essential to give it to new employees so they can get used to the business policies. This provides details such as employee conduct, payroll and other important policies. This acknowledgement form can be as simple as verifying the new hire has read through the handbook.

Need new ideas on what to include in your employee handbook? Read our sample 👈

Retention: At least three years after termination

Performance plans & Job description form

This is to ensure that new employee’s will have a clear understanding of their role within the company as well as what they are expected to accomplish through their performance plans.

Performance plans are important due to providing a clear guide of expectations for the first few months to the end of year performance appraisals.

Want to know how to make a 30-60-90 day plan to create and reach goals? Read here 👈

Retention: performance plans should be updated every year.

New Employee Forms: Start their career smoothly ✅

These forms provide a quick and easy way to gather all the relevant information for a new remote hire. Allowing both them and your business to benefit from a smooth start to their career. They also allow you to set goals and expectations as early as possible to support their professional growth.

Check out our onboarding app to see how you can provide your new hires with the tools for success. 👈

Ready to 3x Your Teams' Performance?

Use the best performance management software to align goals, track progress, and boost employee engagement.