In his annual HR Technology Market Report, Josh Bersin puts forth that the rapidly changing workforce and workplace issues have had an enormous impact on the HR Technology marketplace. Throughout the year, Bersin observed the challenges companies face today. Some of these include:

- Fairness and transparency in the workplace

- Diversity and inclusiveness in people practices

- Social consciousness and acting responsively

- Productivity in the workplace

- External branding of an organization

- Team building

- Internal mobility

- Contract / gig work

- Employee wellbeing

- Employee pay

- Developing leaders

- Assisting the C-Suite

The HR Technology landscape is fundamentally changing from being records-driven to being experience-driven. However, you can’t have the latter without having clearly organized data. As the number of HR Technology applications in the market is expanding, you can now buy any number of applications that help with data organization and even track emails and identify teamwork patterns. There are over 3,800 vendors listed that provide solutions to the challenges above. According to Bersin, a large company will use at least 9 HR systems and spend on average $310 per employee per year – a 29% increase since last year.

We’ve summarized the key takeaways from the 2025 HR Technology Market Report. Our summary covers Bersin’s 15 sections of the report:

1. Core HR Platforms Grow, Competing on New Talent and Experience Features

2. Employee Experience Platforms Arrive: Technology Architecture Will Change

3. Talent Management Tools Expand: Talent Experience Platforms Emerge

4. The Employee Experience Market Is Now Real and Changing Everything

5. Employee Listening, Engagement, and Culture Tools Move to Action Platforms

6. Recruitment Market Changes: AI and Data Now Lead

7. Gig Work, Internal Talent, Career Management Now Major Factors

8. Performance Management Tools Start to Converge

9. Accelerated Reinvention of the Learning Tech Market

10. Wellbeing and Rewards Market Explodes

11. Analytics, AI, ONA, and Natural Language Systems

12. Market Confusion: How Do You Evaluate Vendors?

13. Wrapping It All Up: HR in the Flow of Work

14. The HR Technology Marketplace, 2020: Explosive Growth, Ever-Changing

15. Twelve Categories of the Market

1. Core HR Platforms Grow, Competing on New Talent and Experience Features

The market for core HR platforms (HRMS, payroll and employee management systems) is now well over $8 billion in size and an essential part of the HR technology landscape. Large vendors and mid-sized organizations continue to grow across the market as they direct their offering towards employee experience and productivity, rather than just back-end HR systems. Vendors are transforming their tools into employee self-service platforms that make employees’ work lives easier, integrating with productivity, wellbeing and benefits apps. The driving idea is that Core HR needs to link up to systems “for the moments that matter at work”.

A challenge in this is to design systems that are flexible enough to accommodate complex GDPR laws, varied employment contracts, changes in pay and region-specific work practices, while still presenting an intuitive and user-friendly front-end for the end users.

Trends Among Core HR Vendors

- Make platforms easier to use.

- Ensure mobile-readiness and the ability to use as you go, as workers spend more time on their phones and have less time to spend learning how to use a complex new system.

- Become open platforms so that clients can plug and play their Core HR with other apps to manage recruitment, learning, performance management and engagement.

Workplace Productivity Tools Converge with HR Technology Tools

As more and more working time gets spent in productivity tools (e.g. Office 365, Slack, Facebook Workplace), the HR portals that were bought in the past as standalone destinations now need to be integrated into the flow of work to be effective. Rather than disrupting the flow by forcing employees to enter a standalone portal, HR functions need to be present in the place where employees spend the most time – through chatbots, messages and real-time notifications.

The Networked Organization: Modeling Complex Relationships

The hierarchical job model no longer reflects the actual way in which we work. Agile models need to incorporate cross-functional teams, shared collaborative goals, and complex industry relationships based on skills and connections, rather than job level or title. This has been difficult to model in traditional HCM systems where their database is designed for transaction management, not network modelling. ADP has entered this space with Lifion (name TBC), designed on a graph database with the ability to model and administer any organizational structure based on teams. Bersin predicts that this technology, coupled with blockchain identity management, could form the basis for an entirely new industry of HCM technology over the next five to ten years.

2. Employee Experience Platforms Arrive: Technology Architecture Will Change

In the past, the HR technology stack was fairly simple: you buy your Core HR (HRMS, payroll, benefits administration) and purchase a talent management suite to sit around it. However, the HCM and talent management apps are often designed to meet the needs of back-office HR and IT staff rather than the employee, and increasingly talent management makes more sense as a part of HCM. The HCM vendors are investing heavily in bringing recruitment, performance management, learning and engagement tools within the core HR suite. While not everybody will switch this year, more and more clients are inclined to use the built-in talent management from HCM than use an external service.

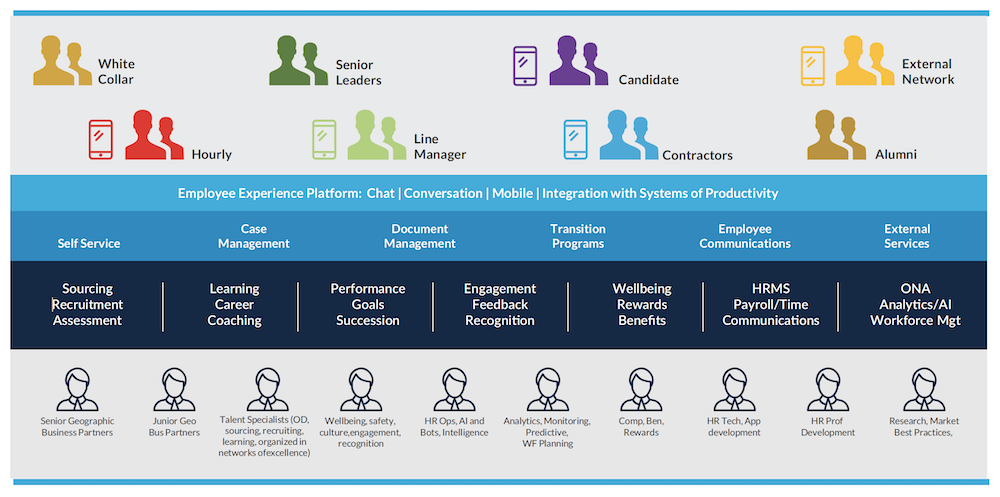

(HR Technology Architecture 2020 and beyond by Josh Bersin)

However, no core HR system can do everything, and the standout talent applications that offer the agility, innovation and analytics that HCM vendors cannot, need to be integrated into the HCM. These advanced tools run the experience and feed that data back to the HCM for record keeping and talent practices.

To facilitate this, HR departments are turning into “app marketplaces” where employees expect to use any combination of core HR, talent and productivity apps within the framework of a single service delivery environment. Vendors like ServiceNow and PeopleDoc aim to be the employee experience-driven point of contact here, to which the HCM platform connects. They design employee journeys, interactions and cases, then talk to back-office systems for talent management and record keeping. These plug and play tools allow clients to deploy an easy-to-use system that integrates with employees in their work, without forcing employees to learn how the core system works.

3. Talent Management Tools Expand: Talent Experience Platforms Emerge

It’s become apparent that the 2020 marketplace for talent application has exploded. With this explosion has come a plethora of categories, with the emerging focus being on improving employee experience from top to bottom.

What we’ve seen within the HCM marketplace is innovation within each segment, driven by new companies, many of which have secured over $10M in funding over the last 5 years. The combination of the products brought together have made up what Bersin describes as a “New Talent Experience Platform Market”.

One of the key features of this market is the growing influence of AI. However, Bersin does not view AI as a feature, but rather as a set of technologies that all vendors will use over time. Nonetheless, the power and productivity of implementing AI vastly depends on the consumer’s data. If the quality of HR data is not sufficient, and the AI technology is not tuned to the right application, the outcome will be null.

HR Systems Architecture

The HR systems architecture team has become more important than ever. You shouldn’t be relying on your IT team to find you the right software – you should now have input from research conducted by HR professionals as to which vendors will suit your organization best, and offer a system with suitable architecture that will offer longevity.

The Emergence of Talent Experience Platforms

The key here is to understand the difference between Talent Management Platforms and Talent Experience Platforms. In Bersin’s words: “Talent management platforms were designed for HR; talent

experience platforms are designed for employees.”. New technology has arisen that focuses on talent experiences such as career planning, looking for a new assignment, finding an expert, or evaluating current pay. The solutions for this are angled towards the employee instead of HR. Many platforms are producing workflow tools, productivity tools, and consumer apps in response.

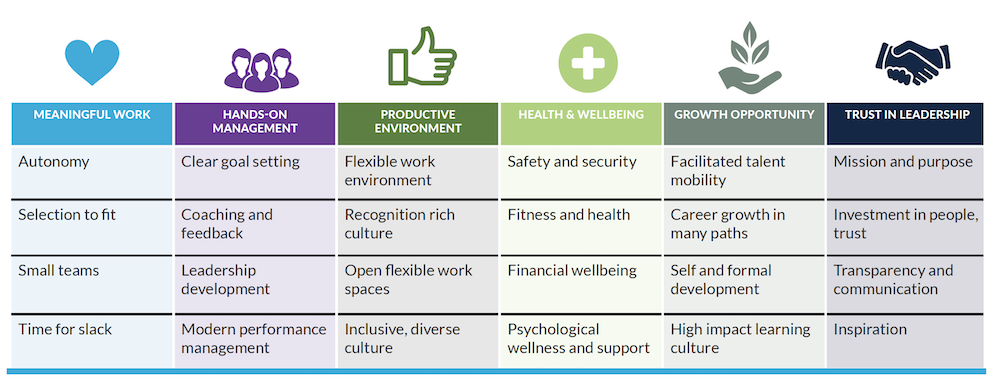

4. The Employee Experience Market Is Now Real and Changing Everything

The Employee Experience Market is disruptive. It’s focused on making work easier, more productive, and more meaningful for workers. This new approach says that, rather than thinking about the product or customer first, we should think about our employees first – since they are the ones who build the product and serve the customers.

(The Complete Employee Experience by Josh Bersin)

There is a shift from ‘transactions’ to ‘moments’ or ‘interactions’. In the literal sense, we are humanizing the touchpoints an employee has with the organization. What Bersin stresses, when designing platforms we should be focusing on these moments from the standpoint of the employee. The outcome is that these new employee experience platforms are not only good HR self-service systems, they also include deep integrations to the HCM, ERP, learning, and recruitment systems, and development tools for monitoring transaction management features as well. Therefore, in a sense, they are a new level of middleware, designed to make it easy for the HR department to design moments that matter and then implement them for employees.

One of the key issues faced when designing these experiences is the back-end HCM systems being so rigid. What we should start seeing in the future is a more flexible approach with each transaction being linked in a fluid manner, and each interaction connecting into the employee’s goal setting, career development, benefits administration, and other talent practices. This is where enabling integrations will be key. Yet again, AI is having a great influence on the EEP market.

One of the biggest changes here will be the eventual role of AI. for instance, IBM’s global HR organization has configured Watson to be the front-end for managers, and HR leaders claim that the Watson-based interface generates over 95% employee satisfaction for a wide range of employee needs. This allows for an overall reduction in need for HR Partners, and bolsters the case for self service models.

This also fits into another system being used by companies such as Facebook: a new service delivery model, organizing for self-service, in which you should think about employee experience as an end-to-end problem. This will enable you to select technology in partnership with IT and Finance, and create a customer-like employee journey.

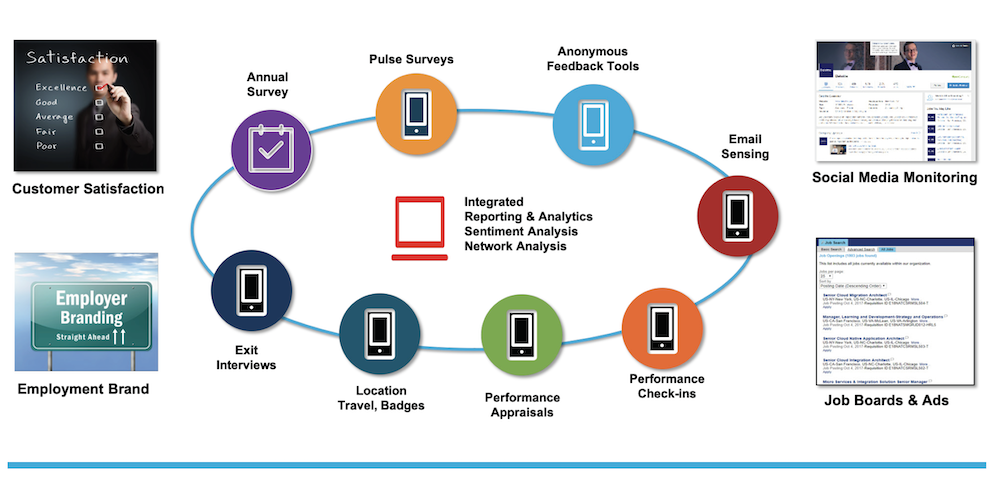

5. Employee Listening, Engagement, and Culture Tools Move to Action Platforms

HR is about 10 years behind Marketing when we compare the employee-sensing system to the customer and prospects systems. Companies are increasingly focusing on this area and are becoming aware of the importance of employee experience.

Today…

- Ongoing feedback is a must-have.

- Around one-third of companies have implemented some type of pulse survey or 360 feedback tool that brings significant value to the company.

- The market has shifted towards real-time, data-heavy platforms that enable you to measure KPIs and provide instant insights to the HR department.

- We can expect each company to develop a kind of internal “Glassdoor” where employees share their opinions, ideas and insights.

Engagement 3.0

With this in mind, we have entered the time of “intelligent nudges” focused on every employee, collecting data from multiple sources such as HRMS and ONA, and focusing on behavioural change. What’s next?

Action Platforms

According to Bersin, “action platforms” interpret data themselves and automatically send nudges, ideas or action plans directly to management.

Categories Starting to Converge

A growing number of tools and vendors are focusing on feedback and looking at it from different perspectives. These include feedback around goals/projects/driven by HR or as a thank you. In the future these tools might become more integrated, collecting employee experience data in many ways.

AI Enters The Market

The market is moving in a direction of advanced sensing and feedback embedded into performance management tools. This provides instant insight into areas of risk and conversational stress, as well as giving ongoing suggestions on how to improve one’s productivity. This is fast becoming a vital part of HR tech.

Feedback Architecture

Sensing and data collection requires a holistic view of all the employee data available. Employee surveys are an integral part of feedback – there are at least 6 types of surveys employers use today. It won’t be a surprise if vendors move in the direction of integrating more and more data sources into one holistic database. Thus, you should think about your efforts as a “multi-year journey” into employee listening.

(Building Enterprise Feedback Architecture by Josh Bersin)

6. Recruitment Market Changes: AI and Data Now Lead

Recruitment can be considered the most important responsibility of managers. Yet almost a third of new hires don’t work out despite extensive recruitment processes. How do we overcome this issue? Through leveraging data, intelligent technology and social sensing tools.

Explosion in Recruiting Technology

Companies that seek out and leverage new technology are achieving compelling improvements in time to hire, cost to hire and quality of hire. Bersin estimates that over 45 million people in the U.S .change jobs every year, and the rates are four to five times higher around the world. The high rates in job changes make recruitment more expensive and require a high number of data and automation tools to make the process less costly and effective. Thus, the ATS market continues to be essential.

The main problem in recruitment is finding people and managing a very complex set of activities such as marketing and branding, creating smart assessment processes or onboarding – amongst others. Therefore, companies require a number of tools to manage these processes. Most of the new vendors facilitate AI to improve recruitment processes. The bigger AI platforms focus on integration and data management in addition to software functionality.

The biggest trend in recruitment is the shift for recruiters to be more focused on conversations and sales, while data analysts spend the time on data and process management. A lot of major organizations are investing in AI software to create more integrated and complex recruitment processes.

AI-Based Assessment

There has been a significant growth in AI- and neuroscience-based assessment. Pymetrics is the leader in the industry, leveraging game-based neuroscience assessments that match candidates with any job in your company. A growing number of companies such as Hackers and or HireArt are developing more job-based assessments, while there is a growing demand for leadership assessment.

Diversity, Inclusion and Bias Detection Tools Go Mainstream

A huge number of new companies such as Vault or HRAcutity have arrived to help manage global diversity, inclusion and bias issues. Gender discrimination is tackled by many organizations including Textio, LinkedIn, GenderDecoder and Greenhouse. Companies such as STRIVR Labs or Equal Reality (among others) offer real-time diversity training to help individuals to manage the biases they are prone to.

7. Gig Work, Internal Talent, Career Management Now Major Factors

Gig work and jobs outside the regular workplace of employees have been growing steadily over the last decade. One of the main reasons that gig work is becoming popular is because technology made it easier. Deliveroo, Postmates, Upwork and Uber are some of the biggest examples. This trend is very popular with younger workers, and interestingly almost 60% of the gig workforce is satisfied with their work-life balance (according to Deloitte). In addition, Deloitte’s report on Human Capital Trends showed that 65% of employees surveyed said it’s easier to find a job outside of the organization than to move within their current company.

Major vendors have started to recognize the need for internal talent marketplaces that promote mobility within an organization and help individuals to find the right career path through project work. According to Bersin, Unilever and Schneider Electric completely manage their workforce as an internal talent market. These changes are not easy as you need to fundamentally change the way you manage people across all levels of the business. The manager becomes a coach, and the organization needs to enable cross-departmental collaboration and communication.

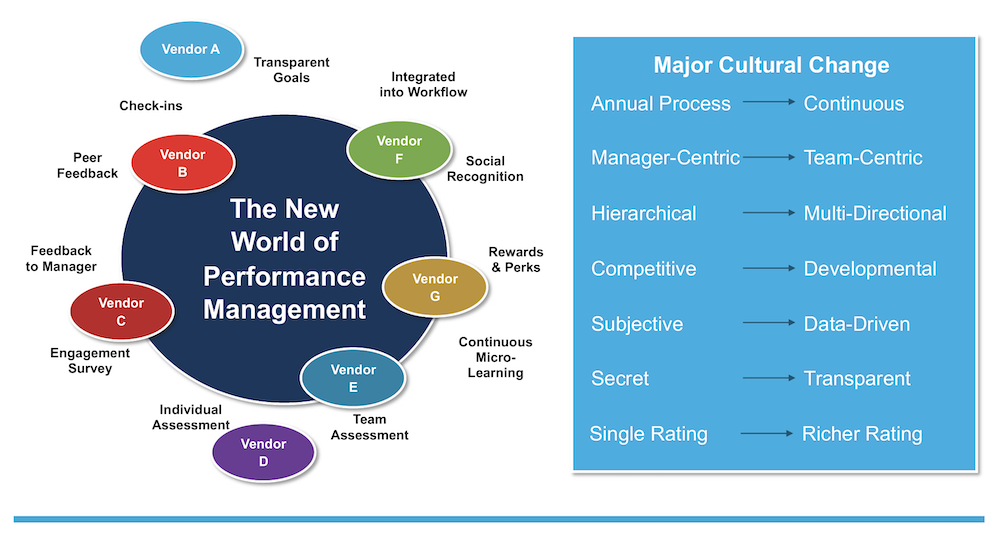

8. Performance Management Tools Start to Converge

Performance management software is becoming very important again as the variety of ways to manage people grows. Continuous performance management, OKRs, 2-way feedback, mentor feedback, and check-ins are some of the most common processes that organizations implement. The features offered by vendors are no longer hierarchical or linear but focus on continuous processes across teams, department and divisions. There are even systems that capture organizational networks by identifying who is providing feedback to who.

It’s not always easy to implement one of these systems, as in many cases large organizations need to implement different process for different teams. For example, a sales team may require a very goal-oriented process, while managers instead require a developmental process.

Bersin argues that every company that implements a continuous process reports that the results are very positive. Offering a regular and transparent process for performance management and evaluation is always adding value. Another benefit of implementing such a solution is the access to better data and insights in the talent process, especially when employees and managers receive feedback from multiple people. Having said that, these tools should be focusing not only on employee performance but also business performance.

Finally, according to Bersin, in the next two years there will be some acquisitions from the market-winners that will help to shape the 21st century talent platform.

(The New World of Performance Management by Josh Bersin)

9. Accelerated Reinvention of the Learning Tech Market

The New World of Academies

Corporate Academies, according to Bersin, are the new paradigm for skills development. These academies are a place within the company where they can internally advance proprietary practices, inventions, and initiatives. In addition to these academies, companies are looking for ways assess the skills of employees. Bersin describes the use of “skill models” as a way to assess and find where skills are strong or weak, making the Skill Model a much-needed technology.

There are essentially three ways to assess skills:

- Assessment. You buy assessment tools or build tests and verify skills through testing.

- Peers. You ask people to tell you the skills of others, and through crowdsourcing responses you identify skilled people.

- Inference and AI. You use new tools to infer skills through people’s experience, work product, and other data.

The LMS Market Falls Behind

The traditional LMS Market is struggling to grow to match the advances in HR technology. Companies are looking to new systems that encompass learning experience tools, collaborative program management tools and micro-learning tools. This shift in learning has caused many traditional LMS vendors to invest in the design of new platforms to focus on creating a more interactive and interesting learning experience.

The New Learning Tech Marketplace

Some of the players in this new market include:

- Learning Experience Platforms: systems that aggregate content from any source, including internally-developed content.

- Program Platforms: platforms that help you gain knowledge by stepping you through an entire curriculum.

- Micro-Learning Platforms: a system that provides adaptive learning paths based on employee’s learning history, job and other factors.

- Assessment, VR and Virtual Learning: providing VR training to help train employees in a virtual environment.

- Content Libraries: a large library of courses and content to meet everyone’s needs within the company.

- Digital Adoption and WorkFlow Learning Tools: giving learning based within the context of roles and helping to make it interactive.

- LMS and Content Platforms: traditional Learning management systems

- Learning Record Stores: a store of learning and data activity without the use of an LMS.

Evolution of the LXP

The first era of LXP products is what Bersin describes as the YouTube-like learning experience. They made the content easily accessible via cloud-based portals, while also making it more engaging than traditional LMS platforms. The second era of LXP introduces the concepts of “people” and “skills” – helping to build a learning platform based around the roles of people within a company and creating a learning path within the LXP. In the third and fourth era of LXP we transition to an integrated learning place with the additions of assessments, advanced analytics and community features. These features will eventually be encompassed into a standalone platform that also includes LMS-like functionality.

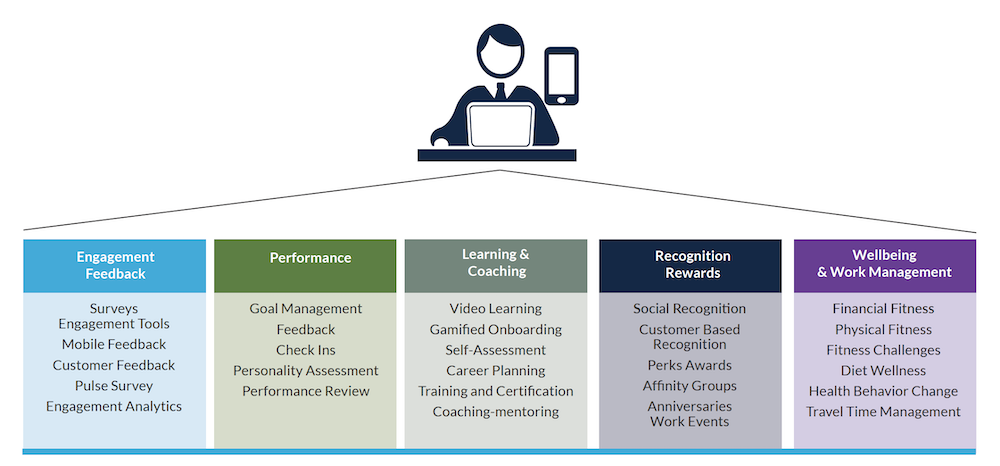

10. Wellbeing and Rewards Market Explodes

There has been an explosive growth in the corporate wellbeing market. Wellbeing is shifting from just health benefits to include performance improvement strategies. With almost two-thirds of employees citing overwork and stress as significant challenges to work productivity, it’s clear what’s driven this change.

More technology is emerging, both independently and as integrations into core HCM systems, surrounding the fundamental wellbeing areas: physical wellbeing, mental wellbeing, financial wellbeing, family wellbeing, and social wellbeing. However, the areas with the most growth today are financial wellbeing (a 61% increase in spending), mental health (a 65% increase in spending), mindfulness and stress management (a 57% increase in spending), and telemedicine or remote care (a 64% increase in spending). Nonetheless, when setting up your systems, it’s vital to look at the demographics of your own workforce to make sure you’re assembling the most popular, in-demand programs.

Most companies are willing to increase their spending on wellbeing as we are moving from a focus on health and fitness to a new focus on employee engagement, productivity, and performance. Over time these wellbeing products will be part and parcel of an entire new performance and productivity suite.

(Convergence of Talent Aquisition Ahead by Josh Bersin)

11. Analytics, AI, ONA and Natural Language Systems

Growth of AI: What is it?

Traditional processes involve people studying problems, designing workflows and working with coded interfaces and algorithms to automate the gathering of analytics and data. As technology advances, with AI and Machine Learning a set of data is run through a program which analyses the data, identifies patterns and creates assumptions – all without human interaction. This AI can be used in many new, exciting and different ways, helping to make our HR decisions more data driven.

Many companies cite the need for improved Analytics skills within the human resources industry, with 3/4 of companies building some sort of analytics database to meet the ever-increasing demand for People Analtyics.

Moving Beyond Traditional Data: Data Scientists Here to Help

People analytics play a large part in the role data scientists have within their HR departments. They are tasked with the collection and interpretation of HR data – an example being of how this data shows the correlation between recognition and internal engagement within an organization.

ONA Goes Mainstream

ONA (Organizational Network Analysis) tools use surveys, meta data, and communications to form a graph of relationships. Using ONA can resolve a multitude of issues within a company through helping HR departments to identify patterns within the network and design custom solutions to address these.

NLP and Chatbots Starting to Mature

Neuro-linguistic programming is another branch of analytics that can be trained to identify the context of a written sentence. Bersin uses the example of the NLP identifying a conversation about vision in your company – whether it’s about vision coverage under an insurance plan or the vision and strategy of the organization. The NLP has to be smart enough and well trained enough to understand this context.

HR Analytics Platforms and Developing Analytics Expertise in the Business

This topic is very popular – almost every HR platform has some sort of analytics module. These modules are very dependent on data management, governance, organizational design, and skills. With the rapidly changing roles in the HR industry, HR professionals embedded in the business have to be familiar, trained, and comfortable with data. They will need the ability to analyze trends and numbers and support their explanations/decisions with data.

12. Market Confusion: How Do You Evaluate Vendors?

When it comes to evaluating vendors it’s not easy. Bersin argues that every company should consider the following questions before selecting a vendor.

1. Does the product or system appeal to users?

This is a make or break issue. When you are considering software for your company you need to make sure that your employees will like it.

2. Does the vendor have the culture of support, and do they value your needs?

A lot of vendors are sales-driven and do not take the time to understand your requirements.

3. Does the vendor have referenceable customers like you?

According to Bersin, you should find three five customers that are similar to your business.

4. Does the vendor have a product team you can relate to?

The vendor you select should deeply understand the space and the domain they cover.

5. Does the vendor have long-term viability in leadership, financials and culture?

Successful vendors understand the customer and market niche. They also have strong leadership and well-trained service people.

13. Wrapping It All Up: HR in the Flow of Work

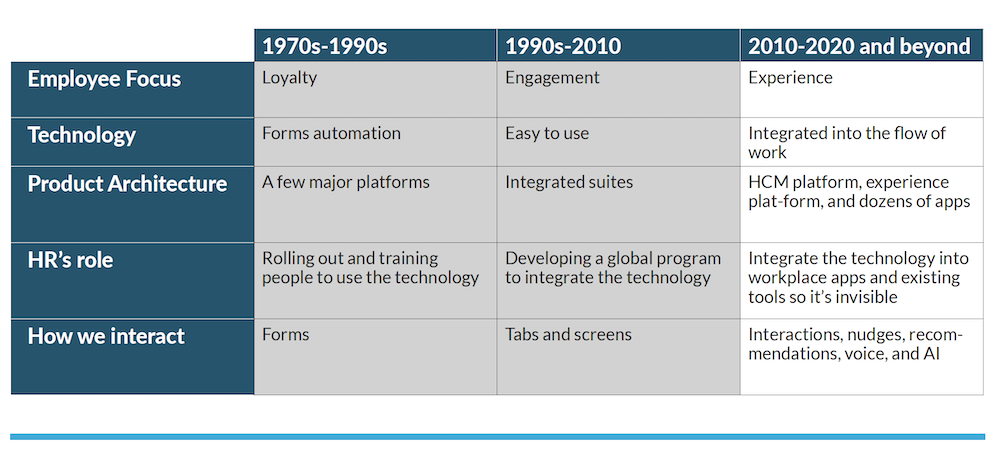

It’s impossible to manage people without tools. Clients need efficient systems for record keeping, payroll, recruitment, learning and development. The key area we’re moving to is how to manage these complex technologies in the most streamlined and efficient way, while delivering a valuable and productive experience for employees. The theme for 2020 and beyond is “HR in the flow of work”.

HR technology has to move away from being a necessary but frustrating interruption to providing a solution to employees that makes work significantly better. It has to be useful to employees, managers and leaders – not just back-office staff. HR systems will struggle to compete with time spent on other work-related activities, so if fits into our day-to-day work life it provides more value. If it’s an interruption and a struggle to understand, engagement drops and your usefulness is lost.

There will never be a one-fits-all system (in fact, the number of HR systems used by large organizations in 2019 went up to an average of 9.1) but as long as the suite is integrated and intuitive, and provides interactions, nudges, and recommendations in the flow of work without being disruptive, employees will adopt systems naturally and HR will enhance the overall employee experience at work.

(Evolution of the Workplace by Josh Bersin)

14. The HR Technology Marketplace, 2020: Explosive Growth, Ever-Changing

“Driven by the tenth year of economic growth, a very tight labor market for hourly and salaried employees, and a tremendous need to upskill, re-skill, and reinvent our skills, the HR Technology market is growing at an explosive rate. Add to this the fact that AI, advanced analytics, sentiment analytics, chatbots, and cognitive tools are now in production – and you have a typhoon that’s growing more powerful and harder to understand by month.” – Josh Bersin

At the same time, companies are undergoing a shift in management practices. Jobs have become more collaborative; communication more complex and instant; work hours longer; stress levels higher and expectations for growth immense. When the economy is growing, the pressure on leadership is even higher. Expectations for market growth expand, yet it becomes more difficult than ever due to the high competition for talent, brand and customers.

According to a Cedar–Crestone study, large companies spend on average $176 to $319 per employee per year on HR technology – and that’s only on the core platforms. The market of developed and developing countries alone comes to an estimated $158 billion. In 2019, 54% of companies have increased their spending on HR technology, 42% have remained steady and just 4% decreased their spending.

The fastest-growing areas are talent management systems and core HR systems, quickly growing with cloud platforms, business intelligence and analytics, workforce management and payroll. In 2019, large companies use over nine different HR systems on average, making the market more difficult to understand than ever before.

15. Twelve Categories of the Market

Bersin identified 12 categories of the HR Technology Market. These are:

- Core HR & Payroll – covers primarily HRMS and payroll. Key requirements for payroll systems is to manage taxes and benefits, and interface with retirement and insurance systems.

- Compensation, Benefits and Rewards systems allows organizations to manage compensation and to conduct compensation benchmarking.

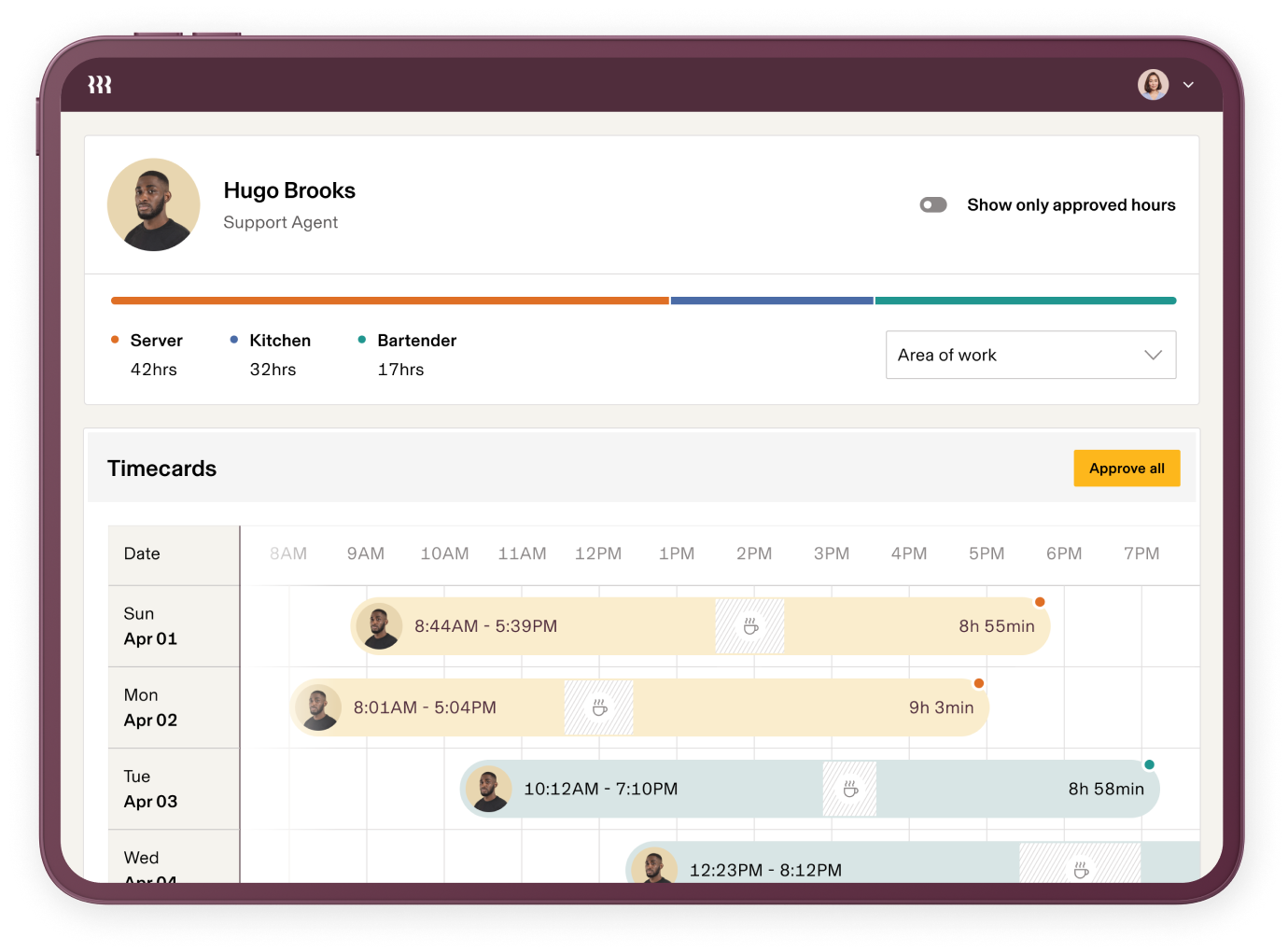

- Workforce Management to manage time and attendance, and measure productivity.

- Integrated Talent Management focuses on succession planning and alumni management. It also has functionality to create competency models.

- Talent Acquisition used for applicant tracking and relationship management.

- Performance Management to manage goals, feedback and reviews.

- Corporate Learning systems for learning and development. The system landscape for learning has changed and lot and there are many vendors offering video learning, micro-learning, AI and bot-based learning.

- Wellbeing Management systems for wellbeing coaching and management, and for developing health networks.

- Engagement and Culture systems that offer employee engagement surveys, pulse surveys and culture reviews.

- Diversity and Inclusion, Transparency Tools are now a category of their own. Most recruiting platforms have features that identify bias or help reduce bias.

- Analytics & Planning systems to analyze employee data in multiple ways. These systems also conduct employee network analysis.

- Workforce Productivity for collaboration and messaging. These productivity systems can be used for learning, developing, setting goals and providing feedback.

Ready to 3x Your Teams' Performance?

Use the best performance management software to align goals, track progress, and boost employee engagement.