It is essential to follow strict compliance guidelines when regulating overtime compensation. Employers who underpay employees for hours worked overtime can suffer enormous financial consequences. Human resources professionals need to be aware of employee classification to ensure they avoid fines from the Department of Labor (DOL). In this article, we will explain the difference between exempt vs non exempt employees under the Fair Labor Standards Act and help you understand how to classify your workforce.

Fair Labor Standards Act

The Fair Labor Standards Act (FLSA) is a piece of legislation in the United States that establishes a fair minimum wage and overtime pay. The act states that employees in the United States should receive at least the federal minimum wage for hours worked, and are entitled to overtime pay for any hours worked over 40 hours in a workweek.

If an employer breaches the FLSA or improperly classifies its employees, they are subject to hefty fines from the Department of Labor. However, Section 13(a)(1) of the FLSA provides an exemption from both minimum wage and overtime pay for certain individuals and professions. Read on to learn how an employee achieves exempt status, and the difference between exempt and non exempt employees.

Exempt vs Non exempt employees

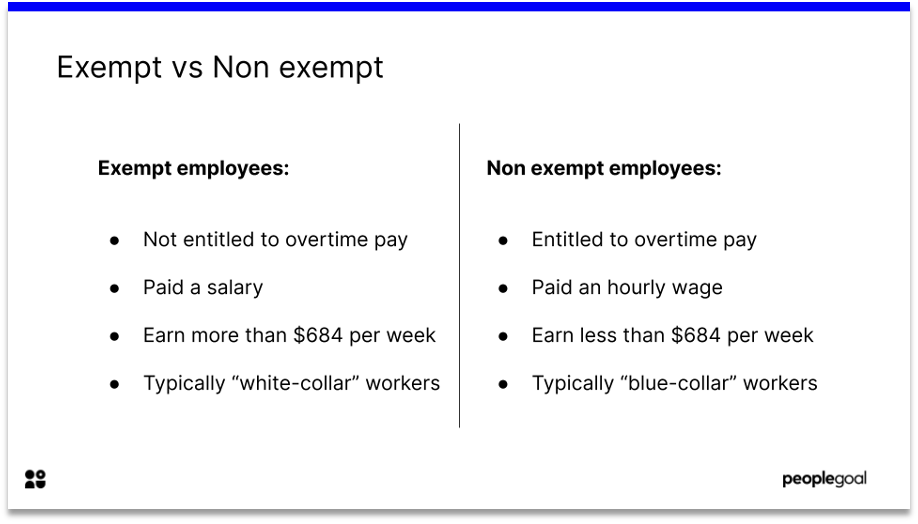

There are two types of employees in the workplace according to the FLSA: exempt employees and nonexempt employees. The main difference between the two types boils down to overtime rules. Simply put, non exempt employees are entitled to overtime pay and as the name suggests, exempt employees are not. Whilst most employees protected by the FLSA are non exempt, some are not.

Whether you are exempt or nonexempt depends on a variety of factors. Some professions (such as outside sales employees) are exempt by definition. However, for most people their employment classification depends on 1) how they are paid, 2) how much they are paid and 3) the kind of work they do.

In a nutshell, exempt employees are not entitled to overtime pay under the FLSA. They are expected to carry out their tasks regardless of whether they work overtime or not. To qualify as exempt, you must earn over a certain amount per week. Almost all non-exempt employees are paid federal minimum wage, whereas non-exempt employees can be paid either by the hour or a salary. Finally, non-exempt employees are protected by FLSA regulations and must be paid for any hours worked overtime.

To further explore the differences between the two types of classification, we will break down each one in more detail.

Non exempt employees

Non-exempt employees are not exempt from the FLSA regulations and therefore must be paid at least the federal minimum wage of $7.25 per hour and are entitled to overtime pay. A nonexempt employee is paid hourly (rather than on a salary), and must be paid for any hours worked overtime. According to the FLSA, non exempt employees are entitled to one and half times their regular rate of pay when working more than 40 hours each week.

Non exempt employees typically earn less than $684 per week, although this is not always the case. They tend to be directly supervised by managers who control their workflow. Most nonexempt employees perform manual work or carry out orders without inputting managerial decisions.

Non exempt employee examples:

- Blue-collar workers (including carpenters, electricians, mechanics, plumbers, iron workers, craftsmen, operating engineers, construction workers and laborers)

- Police, Fire Fighters, Paramedics & Other First Responders

Exempt employees

Exempt employees are paid an annual salary and are not entitled to overtime pay in accordance with the Fair Labor Standard Act. To be classified as exempt, employees must meet a range of criteria outlined by the Department of Labor. FLSA was updated, stating that exempt employees must be paid at least $684 per week on a salary basis (a rise from $455 per week). They must also perform certain exempt job duties which are detailed below.

Exempt employees typically perform high-level duties.They are referred to as ‘white-collar workers’ due to the fact they are skilled or formally trained professionals who typically work in an office environment. They usually manage a few members of staff. It is important to note that job titles do not determine exempt status. Instead, for an exemption to apply their salary and job duties must meet all of the Department of Labor’s regulations.

Exemption tests:

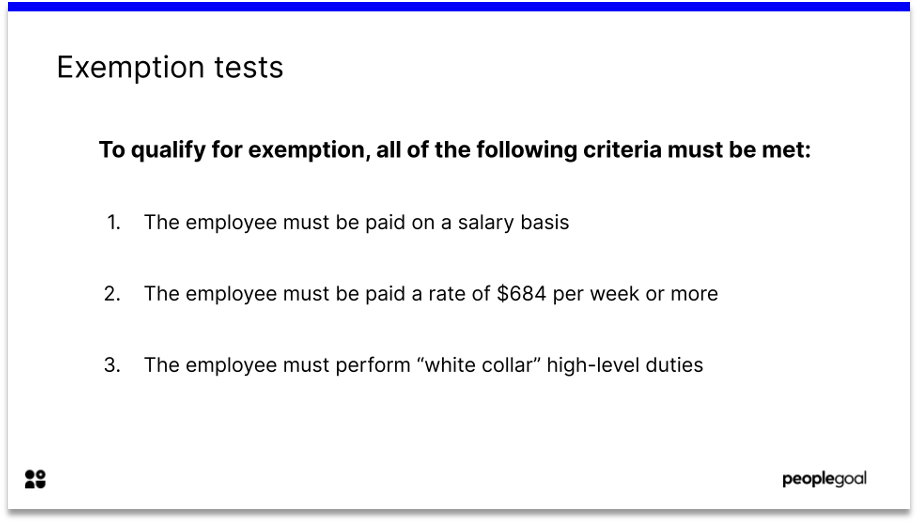

To qualify for exemption, all of the following criteria must be met:

- The employee must be paid on a salary basis

- The employee must be paid a rate of $684 per week or more

- The employee must perform “white collar” high-level duties

Exempt employee examples:

The Fair Labor Standards Act recognizes the following key categories of exempt workers. Each of these categories must meet the specific criteria outlined by the FLSA.

- Executive

- Administrative

- Professional

- Computer employees

- Outside sales

- Highly compensated employees

Note: Not all states have the same guidelines for exempt employees. Ensure you check with your state labor department for the latest overtime provisions in your area.

Why you need to know the difference

It is vital to properly classify employees and accurately record their overtime to ensure your organization meets compliance requirements. As an employer, you should be clear on the distinctions between exempt vs non-exempt employees and establish appropriate practices for overtime pay. Improperly classifying employees can lead to some serious fines from the Department of Labor. You might want to use a time tracking and attendance software to automate the process, ensuring you are never caught out.

Check out our Top Ten Payroll Providers for Small Businesses if you want to find out more.

Ready to 3x Your Teams' Performance?

Use the best performance management software to align goals, track progress, and boost employee engagement.