Managing payroll for small businesses has become increasingly convenient with the abundance of high-quality payroll software options available in the market. These software solutions are essential tools that streamline wage payments, benefits calculations, and tax obligations. They have replaced manual systems and printed pay slips, ushering in a new era of digital efficiency. Cloud-based payroll solutions have revolutionized business operations by providing secure backups, digital record-keeping, and convenient employee access to pay information.

This digital transformation offers additional advantages, including improved communication channels for employees to submit queries and centralized support. Whether opting for an office-installed software or a cloud-based solution, it is crucial to ensure seamless integration with existing accounting packages. The best payroll software typically comes from reputable providers of accounting software, ensuring compatibility and smooth operation.

When selecting an ideal payroll software for small businesses, our focus was on identifying reliable features such as unlimited payroll runs, user-friendly interfaces for both employees and administrators, and seamless accessibility. Additionally, we assessed the quality of customer support available through various channels such as phone, email, and chat, as well as the availability of comprehensive documentation for learning purposes.

Without further delay, here are the top payroll software platforms currently available, offering exceptional experiences for small businesses.

-

- Comprehensive HR and payroll services.

- User-friendly interface with automated payroll processing.

- Suitable for businesses of all sizes.

-

Deel:

- Specializes in international payroll and compliance.

- Simplifies cross-border payments and ensures transparency in global employment contracts.

- Ideal for businesses with an international workforce.

-

- Designed for international employment.

- Facilitates smooth onboarding and compliance with local labor laws.

- Offers excellent customer support for global HR and payroll needs.

-

ADP:

- Well-established payroll service provider.

- Offers a wide range of features, including automated payroll processing, tax calculations, and employee self-service portals.

- Suitable for businesses of all sizes.

-

- Provides end-to-end global payroll and workforce management solutions.

- Known for dedicated customer support and ease of use.

- Offers a single source of truth for payroll data and helps turn payroll into a strategic asset for businesses.

A quick comparison of the top Payroll Providers for 2023

Rippling, Deel, OysterHR, ADP, and Papaya Globoal are all payroll systems that provide HR and payroll services to businesses. Here is a concise comparison of these systems:

Rippling

Rippling: Rippling is an all-in-one HR and payroll platform that offers automated payroll processing, employee benefits management, time tracking, and employee onboarding. It integrates with various other business systems and provides a user-friendly interface.

Deel

Deel: Deel focuses on remote and international payroll solutions. It helps businesses manage payroll for their remote teams, including compliance with local labor laws and tax regulations. Deel streamlines contractor payments and offers multi-currency support.

Deel

OysterHR: OysterHR is a global HR and payroll platform designed specifically for remote teams. It handles international payroll, benefits administration, and compliance in multiple countries. OysterHR also offers tools for onboarding, time tracking, and contractor management.

ADP

ADP: ADP (Automatic Data Processing) is a well-established payroll provider offering a range of HR and payroll solutions. It caters to businesses of all sizes and provides comprehensive payroll processing, tax management, benefits administration, and employee self-service features.

Papaya

Papaya: Papaya Global stands as a leading SaaS fintech firm, offering cutting-edge global payroll and payments technology tailored specifically for global enterprises. At its core, Papaya is a comprehensive automated solution that equips finance teams with the visibility, agility, and control needed to manage workforce spending effectively. Serving as the central hub, Papaya seamlessly connects the intricate threads of global payroll, harmonizing data from various sources and seamlessly integrating with HCM and ERP tools, ultimately establishing a singular, dependable source of truth. In essence, Papaya transforms payroll, traditionally a company’s most significant cost and potential liability, into a strategic asset.

Overall, Rippling, Deel, OysterHR, ADP, and Gusto are all reputable payroll systems with varying features and target audiences. Businesses should consider their specific needs, such as international payroll, remote team management, or scalability, to choose the most suitable option.

1. Rippling – Magically Simplify HR, IT, and Finance

Rippling Payroll is a payroll processing solution offered by Rippling, an all-in-one HR and payroll platform. Here is a summary of Rippling Payroll, including pricing information and its pros and cons:

Pricing:

Rippling Payroll’s pricing is based on the number of employees in your organization. The cost starts at $8 per employee per month for businesses with up to 100 employees. Additional features, such as benefits administration and IT management, may have additional costs.

Pros:

- Streamlined payroll processing: Rippling Payroll simplifies the payroll process by automating calculations, tax filings, and direct deposits. It offers features like flexible pay schedules, time tracking integration, and customizable deductions, making payroll management more efficient.

- Integration with HR and benefits: As part of the Rippling platform, Rippling Payroll seamlessly integrates with other HR and benefits management features. This integration allows for a unified employee record, making it easier to manage employee data across different functions.

- Employee self-service: Rippling Payroll provides self-service features that empower employees to access their pay stubs, update their personal information, and make changes to their direct deposit preferences. This reduces administrative burden and increases employee satisfaction.

Cons:

- Limited international payroll support: Rippling Payroll primarily focuses on payroll processing within the United States. If your business has international operations or employees located outside the U.S., you may find the international payroll support limited.

- Complex pricing structure: Rippling Payroll’s pricing is based on the number of employees and additional features required. This pricing structure can be complex, especially for businesses with fluctuating employee counts or specific needs. It’s important to carefully evaluate the costs based on your organization’s requirements.

- Customer support challenges: Some users have reported challenges with customer support, including delays in response times and difficulty in resolving issues. Depending on your business’s support needs, this could impact your experience with the platform.

In summary, Rippling Payroll is a payroll processing solution that simplifies the payroll management process with automation and integration capabilities. It offers employee self-service features and integrates well with other HR and benefits functions. However, international payroll support may be limited, the pricing structure can be complex, and there may be challenges with customer support. It’s important to assess these factors against your specific payroll requirements before choosing Rippling Payroll.

Rippling Reviews: What Customers Have to Say

Rippling provides HR solutions that are incredibly user-friendly and efficient. Their platform organizes all the essential items I need as an employee in a clear and easily accessible manner, making it a breeze to find and navigate through everything. It was particularly helpful when I had to re-enroll in my company’s insurance plan recently, streamlining the process and saving me a lot of time and hassle. – Everett (September 2023)

Rippling has proven to be an invaluable tool for me as an admin at a startup, particularly in the insurtech sector. It empowers me to efficiently manage various aspects of our team, from reviewing training progress and assigning new courses from an extensive library to accessing essential personnel and key information. The Single Sign-On (SSO) functionality is a standout feature, simplifying our tech tool access by centralizing all our log-ins in one convenient location. Moreover, Rippling’s responsiveness to our needs is remarkable; they consistently address our issues promptly, often providing a response within a single day. – Lauren (August 2023)

Rippling stands out for its convenience in providing employees with seamless access to a wide range of essential information and functions, be it related to health benefits, payroll, time off, or expenses, all accessible from their computer or mobile devices. This user-friendly platform enables employees to make adjustments to their 401(k) contributions or direct deposit preferences effortlessly, eliminating the need to rely on human resources personnel for such tasks. Rippling fosters a sense of independence for both employees and employers, simplifying and streamlining these processes. – Mary (July 2023)

Deel – Everything you need to scale a global team

Deel Payroll is a payroll solution specifically designed to meet the needs of remote and international teams. Here is a summary of Deel Payroll, including pricing information and its pros and cons:

Pricing:

Deel Payroll’s pricing varies based on the specific needs of each business, such as the number of employees and the countries involved. It’s best to contact Deel directly to get accurate pricing information for your organization.

Pros:

- Remote and international payroll expertise: Deel specializes in providing payroll solutions for businesses with remote teams or operations in multiple countries. It helps navigate the complexities of international payroll, including compliance with local labor laws and tax regulations.

- Simplified contractor payments: Deel streamlines the payment process for contractors, offering features such as automated invoicing, international payment processing, and multi-currency support. This simplifies the management of contractor payments and helps maintain compliance.

- Compliance and legal support: Deel provides legal support and templates for creating compliant contracts for remote workers and contractors. It helps businesses ensure legal compliance in various jurisdictions and reduces the risk of misclassification or legal issues.

Cons:

- Limited focus on traditional payroll: While Deel excels in remote and international payroll, it may have limitations when it comes to traditional payroll features for businesses with on-site employees or operations confined to a single country. It is important to assess if Deel’s specific focus aligns with your business needs.

- Pricing transparency: Deel’s pricing structure is not publicly available on their website. To get accurate pricing information, businesses need to contact Deel directly, which may make it difficult to compare costs or determine the suitability of the service without initial discussions.

- Limited additional HR features: Deel primarily focuses on payroll and contractor management, so it may have limited additional HR features compared to comprehensive HR and payroll platforms. Depending on your organization’s needs, you may require additional HR functionalities that Deel does not provide.

Deel Payroll Reviews: What Customers Have to Say

Deel has won my trust due to their unwavering commitment to on-time payments (with any rare delays stemming from issues on the client company’s end, not Deel’s fault). What’s even more impressive is Deel’s daily updates of conversion rates, ensuring that the rates you see are always current. Additionally, their user-friendly transfer process to a Deel card adds incredible flexibility, eliminating the need to transfer funds to your bank account before making purchases. It’s truly a fantastic feature! – Sebastián (September 2023)

Being an international employee often involves grappling with complex payroll processes, but my experience with Deel, the cloud-based payroll software, has been remarkably smooth. Deel has truly revolutionized my international employment journey, making it more transparent, hassle-free, and efficient. What sets Deel apart is its commitment to swift and secure payments, ensuring that I receive my earnings accurately and punctually, regardless of my global location. Moreover, Deel’s platform offers clarity and transparency through easy access to payment history and comprehensive salary breakdowns. The customer support team at Deel has consistently demonstrated responsiveness and helpfulness, offering valuable assistance whenever I’ve had questions or needed guidance. With its user-friendly interface, Deel simplifies the entire process, allowing me to navigate the platform with ease, making it an invaluable resource for employees like myself. – Paulette (September 2023)

Deel’s outstanding feature is its unwavering dedication to contractor security, offering not only contract creation but also clear payment timelines to safeguard professionals like myself. Additionally, the platform provides flexible financial management options, allowing for advances and optimal withdrawal scheduling, greatly simplifying personal finance. Its user-friendly design ensures a seamless navigation experience, which is particularly beneficial for users who may not be tech-savvy. Furthermore, Deel’s transparent payment system is commendable, promptly notifying contractors of payment delays and providing essential context when needed. – Jimena (August 2023)

In summary, Deel Payroll specializes in remote and international payroll, making it an excellent choice for businesses with distributed teams or operations across multiple countries. It simplifies contractor payments and provides legal support. However, it may have limited traditional payroll features, pricing transparency can be an issue, and additional HR functionalities may be limited. Consider your specific remote and international payroll needs when evaluating Deel as a payroll solution.

OysterHR – Employement reimagined

OysterHR is a global HR and payroll platform designed for remote teams. Here is a summary of OysterHR, including pricing information and its pros and cons:

OysterHR’s pricing varies based on factors such as the number of employees, countries involved, and additional services required. It is best to contact OysterHR directly to get accurate pricing information tailored to your organization’s needs.

Pros:

- Global payroll and compliance: OysterHR specializes in global payroll and provides support for managing payroll in multiple countries. It helps businesses navigate the complexities of international payroll, including compliance with local labor laws, tax regulations, and employment requirements.

- Remote team management: OysterHR offers features specifically tailored for remote teams, such as streamlined onboarding processes, time tracking, and management of contractors and remote employees. It helps businesses manage their remote workforce more efficiently.

- Benefits administration: OysterHR provides tools and support for benefits administration, including health insurance, retirement plans, and other employee benefits. This simplifies the process of managing benefits across different countries and helps ensure compliance.

Cons:

- Pricing complexity: OysterHR’s pricing structure is not publicly available, and the exact costs may vary based on various factors. Getting accurate pricing information requires contacting OysterHR directly, which may make it challenging to compare costs or determine the affordability of the service without initial discussions.

- Potential learning curve: As OysterHR is designed to handle global HR and payroll tasks, there may be a learning curve associated with understanding and utilizing its features effectively. Users may need time to familiarize themselves with the platform and its functionalities.

- Limited focus on local payroll: While OysterHR excels in managing global payroll and compliance, its focus on international operations may result in fewer features or limited support for businesses with operations confined to a single country. It is important to assess if OysterHR’s specific focus aligns with your business needs.

My experience with Oyster has been nothing short of exceptional. They have provided professional services paired with an extensive knowledge base regarding the legal intricacies of the country I needed employment in. The onboarding process was remarkably smooth, thanks to the helpfulness and kindness of their agents. What pleasantly surprised me even further was the exceptional customer care I received after onboarding. They consistently responded within 24 hours, and when challenges or concerns arose, their support was always both professional and compassionate, offering the necessary assistance. – Eugenio (July 2023)

My experience with Oyster as a user during my onboarding with my new organization was incredibly smooth. The provided details were clear, and any questions or concerns I had were promptly addressed by the onboarding contact person. The flexibility to sign agreement documents using a custom signature or the built-in signature feature proved to be highly efficient. In summary, my experience with Oyster was excellent, and I found the overall onboarding process to be highly satisfactory. – Ayan (July 2023)

This marks my initial contract engagement with Oyster, and I’m pleased to report that the onboarding process went exceptionally smoothly. The help desk has consistently demonstrated responsiveness, and the Oyster team is genuinely dedicated to simplifying your experience. Throughout this first year, I have encountered no issues, and I can wholeheartedly recommend this platform. – Timur (July 2023)

In summary, OysterHR is a global HR and payroll platform designed for remote teams, offering features such as global payroll management, compliance support, and benefits administration. However, its pricing structure may be complex, there may be a learning curve associated with using the platform, and it may have limitations for businesses focused solely on local payroll. Considering your specific global HR and payroll needs will help determine if OysterHR is the right solution for your organization.

ADP Payroll – Simplify HR and payroll services

ADP (Automatic Data Processing) is a well-established payroll provider offering comprehensive HR and payroll solutions to businesses of all sizes. Here is a summary of ADP Payroll, including pricing information and its pros and cons:

Pricing:

ADP’s pricing structure is tailored to each business’s specific needs, such as the number of employees, payroll complexity, and additional services required. As a result, pricing can vary significantly. It’s best to contact ADP directly to get a personalized quote.

Pros:

- Scalability and comprehensive features: ADP offers scalable payroll solutions that can accommodate the needs of businesses ranging from small startups to large enterprises. It provides a wide range of features, including payroll processing, tax management, benefits administration, time and attendance tracking, and employee self-service capabilities.

- Compliance expertise: ADP has extensive experience and resources to navigate complex payroll and tax regulations. They stay updated with changing laws and regulations, reducing the burden on businesses to ensure compliance. ADP also offers tools and services to help manage compliance with healthcare and retirement plan regulations.

- Integration capabilities: ADP integrates with a variety of other business systems, such as accounting software, time and attendance systems, and HR management tools. This integration streamlines data synchronization and improves overall efficiency.

Cons:

- Pricing complexity: ADP’s pricing structure is not transparently available on their website and can be complex. The pricing is often customized based on the specific needs of each business, which may make it challenging to compare costs or understand the full pricing details without contacting ADP directly.

- Customer support limitations: Some users have reported challenges with ADP’s customer support, such as delayed response times or difficulties in resolving issues. The level of support may vary based on the specific service package or contract negotiated with ADP.

- Potential feature overload: ADP’s extensive range of features and services may be overwhelming for smaller businesses with simpler payroll needs. Some businesses may find that they are paying for features they don’t fully utilize or need.

ADP Payroll Reviews: What Customers Have to Say

ADP Payroll services offer an easily navigable user interface, making them accessible for businesses of all sizes. Their round-the-clock customer support is readily available to address any issues that may arise. Businesses choose ADP for its comprehensive suite of features, including pay reporting, tax handling, claims processing, and convenient access to reimbursement records. Employees frequently utilize the platform to view pay stubs and submit claims, while seamless integration options make ADP Payroll services a practical choice for businesses. Additionally, the customer support desk simplifies requests for operational support related to Gratuity, PF, PT, SA, and income taxes. –

Sowmya (October 2023)

ADP Payroll Services provides a comprehensive array of options, encompassing employee attendance tracking, payroll processing, and more, eliminating the need for multiple software solutions. This all-in-one platform simplifies our tasks significantly, eliminating the need for manual intervention and saving valuable time by automating processes. – Amith (September 2023)

The ease of generating reports is remarkable – just a few clicks, and it’s done. Moreover, the system automatically sends these reports to the relevant recipients promptly, ensuring timely communication. Plus, the reports are typically available right after our payroll processing is completed. – Leah (September 2023)

In summary, ADP Payroll offers scalable and comprehensive payroll solutions with a strong focus on compliance. It integrates well with other systems and provides a wide range of features to meet the needs of businesses of all sizes. However, its pricing structure can be complex, customer support may have limitations, and smaller businesses may find some features unnecessary or overwhelming. It is recommended to carefully evaluate ADP’s offerings and pricing to determine if they align with your specific payroll requirements.

Papaya Payroll – Master payroll & payments

Papaya Payroll is a user-friendly payroll processing solution designed for small and medium-sized businesses. Here is a summary of Papaya Payroll, including pricing information and its pros and cons::

Pricing:

Papaya offers tiered pricing plans based on the features and services you need. The pricing starts at a base fee, with additional costs per employee per month. The exact pricing varies depending on factors such as the number of employees, payroll frequency, and additional features.

Pros:

- Easy-to-use interface: Papaya Payroll provides a user-friendly and intuitive interface, making it accessible to users with varying levels of payroll expertise. The platform simplifies payroll tasks, such as running payroll, generating pay stubs, and managing tax filings.

- Comprehensive payroll features: Papaya offers a wide range of payroll features, including automated calculations, direct deposits, tax filing, and year-end reporting. It also handles new hire reporting, compliance, and integration with accounting software, streamlining the payroll process.

- Employee self-service and benefits: Papaya enables employees to access their pay stubs, tax documents, and make changes to their personal information via a self-service portal. It also offers additional features for benefits administration, including health insurance and retirement plans.

Cons:

- Pricing for additional features: While Papaya’s base pricing is competitive, some additional features, such as benefits administration or HR tools, may incur additional costs. Businesses should carefully evaluate their requirements and associated costs when considering these features.

- Limited international capabilities: Papaya primarily focuses on payroll processing within specific regions. If your business has international operations or employees located outside the supported regions, Papaya may not provide comprehensive support for international payroll and compliance needs.

- Customer support limitations: While Papaya offers customer support, some users have reported challenges with responsiveness and getting timely assistance. Depending on your support needs, it is important to consider the level of support provided when evaluating the platform.

Papaya Reviews: What Customers Have to Say

What I appreciate most about Papaya is their dedicated payroll expert who is always available to assist us. They consistently address our questions and concerns in a highly professional and prompt manner. Additionally, their streamlined onboarding process for new employees saves us time and ensures a seamless registration experience for newcomers on the portal. –

Yogita (September 2023)

Papaya provides exceptional customer support throughout the entire employee lifecycle. Among our various vendors, Papaya stands out as our ideal business partner. Their agility and commitment to enhancing their services based on feedback is truly impressive. – Liron (October 2023)

The Customer Success Managers and Support team at Papaya Global demonstrate great proactivity, which is highly beneficial. Their platform is incredibly user-friendly and offers a wealth of valuable information about each country. Our team relies on this platform daily. Victoria (October 2023)

In summary, Papaya Payroll is a user-friendly payroll processing solution suitable for small and medium-sized businesses. It offers comprehensive payroll features, a user-friendly interface, and employee self-service capabilities. However, businesses should consider additional costs for features beyond the base payroll functionality, and Papaya’s support for international payroll and compliance may be limited based on regional availability.

Payroll Systems – Questions for vendors to consider

Here is a list of common questions and answers to consider when evaluating different payroll vendors:

1. What features and services does the payroll vendor offer?

Look for features such as automated payroll processing, tax filing, direct deposit, employee self-service portals, and integration with other HR or accounting systems.

2. What is the pricing structure and cost of the payroll service?

Inquire about pricing models, whether it’s based on the number of employees, usage tiers, or additional features. Understand if there are any setup fees, transaction fees, or additional charges for specific services.

3. Does the payroll vendor support compliance with tax and labor regulations?

Ensure that the vendor has a good understanding of local, state, and federal tax regulations and can handle tax filings accurately and on time. Ask about their compliance track record and any guarantees they offer.

4. Can the payroll system handle my specific payroll needs?

Consider factors such as different pay schedules, multiple locations or subsidiaries, complex deductions, benefits administration, and contractor payments. Ensure the vendor’s system can handle these requirements effectively.

5. How user-friendly is the payroll system?

Ask about the ease of use of the platform and if it offers a user-friendly interface. Inquire about employee self-service options and mobile access for convenient payroll management.

6. What level of customer support is provided?

Understand the vendor’s customer support availability, response times, and support channels. Inquire about their support team’s expertise and if there are additional costs for support services.

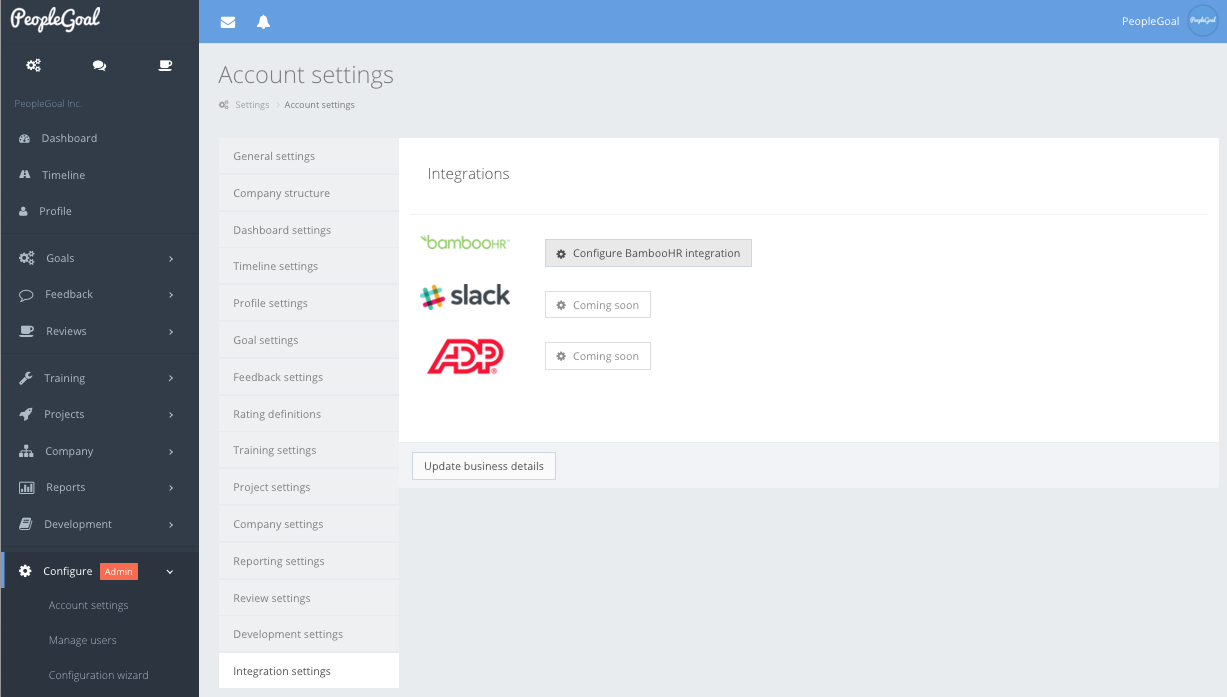

7. Does the payroll vendor offer integrations with other systems?

Check if the payroll system can integrate with other systems you use, such as accounting software, time and attendance systems, or HR management tools. This integration can streamline data sharing and reduce manual entry.

8. Can the payroll vendor handle international payroll and compliance?

If you have international operations or remote workers, ensure the vendor can handle global payroll requirements, including compliance with local labor laws, tax regulations, and payment methods.

9. What security measures are in place to protect sensitive payroll data?

Inquire about the vendor’s data security protocols, encryption standards, and access controls to ensure the confidentiality and integrity of your payroll information.

10. Can the payroll vendor provide references or customer testimonials?

Request references or testimonials from existing clients to get insights into their experience with the payroll vendor, the quality of service provided, and overall customer satisfaction.

Remember, these questions may vary depending on your specific business requirements. It’s important to tailor your questions to address your organization’s unique needs and concerns when evaluating payroll vendors.

Key Areas to Consider When Implementing a Payroll System

Implementing a payroll system is a complex process that requires careful planning and attention to detail. Here are key areas to consider when implementing a payroll system:

-

Legal and Regulatory Compliance:

- Ensure that your payroll system adheres to all federal, state, and local labor laws and tax regulations.

- Stay updated on changing tax laws and regulations to ensure ongoing compliance.

-

Data Security and Privacy:

- Implement robust security measures to protect sensitive employee data, including encryption, access controls, and regular security audits.

- Comply with data privacy regulations such as GDPR, CCPA, or any other relevant laws.

-

Payroll Processing Workflow:

- Define and document your payroll processing workflow, including roles and responsibilities at each step.

- Establish clear procedures for handling exceptions, corrections, and retroactive changes.

-

Integration with HR and Timekeeping Systems:

- Ensure seamless integration with your HR management system and timekeeping software to streamline data flow.

- Verify that employee information, such as hours worked, benefits, and deductions, is accurate and up-to-date.

-

Payroll Software Selection:

- Choose a payroll software solution that aligns with your organization’s needs and scalability, considering factors like size, complexity, and budget.

- Evaluate software options for user-friendliness and robust reporting capabilities.

-

Employee Data Management:

- Collect and maintain accurate employee data, including personal information, tax withholding details, and benefit elections.

- Establish a process for onboarding and offboarding employees within the payroll system.

-

Tax Withholding and Reporting:

- Set up tax tables and calculate tax withholdings accurately.

- Ensure timely and accurate filing of payroll tax reports, including quarterly and annual filings.

-

Payment Methods and Frequency:

- Determine how employees will be paid (e.g., direct deposit, paper checks) and the frequency of payrolls (e.g., weekly, bi-weekly, monthly).

- Implement a secure payment distribution process.

-

Employee Self-Service Portal:

- Provide employees with a self-service portal to access pay stubs, tax forms, and update personal information.

- Ensure that the portal is user-friendly and secure.

-

Testing and Training:

- Thoroughly test the payroll system before it goes live to identify and rectify any issues.

- Provide comprehensive training to payroll administrators and end-users to ensure they can effectively use the system.

-

Backup and Disaster Recovery:

- Implement backup and disaster recovery plans to protect payroll data in case of system failures or data loss.

- Regularly test these procedures to ensure they work effectively.

-

Audit and Compliance Monitoring:

- Establish a system of regular audits and compliance checks to identify and address errors, discrepancies, and potential issues promptly.

-

Communication and Change Management:

- Communicate the changes and improvements associated with the new payroll system to employees and stakeholders.

- Manage the transition to minimize disruption and ensure a smooth implementation.

-

Vendor Support and Maintenance:

- Establish a relationship with the payroll software vendor and understand the support and maintenance they provide.

- Keep the software up to date with the latest patches and updates.

-

Feedback and Continuous Improvement:

- Collect feedback from users and administrators to identify areas for improvement in the payroll process and system.

- Continuously refine and enhance the system based on feedback and changing needs.

By addressing these key areas, you can increase the chances of a successful payroll system implementation that meets the needs of your organization while ensuring legal compliance and data security.

Further reading from our blog

👉 Modernizing Employee Performance Management in Medium and Large Organizations

👉Employee Self-evaluation Sample Answers for Key Soft Skills

👉Employee Code of Conduct: Best Practices and Examples

👉Employee Performance Improvement Plan: 8 tips to make it work

Ready to 3x Your Teams' Performance?

Use the best performance management software to align goals, track progress, and boost employee engagement.

![What Is EPM Software? [Detailed Guide + Best Tools]](https://www.peoplegoal.com/blog/wp-content/uploads/2025/03/New_enterprise-performance-management-software.png)

![Top 10+ HRIS Systems for 2025: The Ultimate HRIS Guide [Updated]](https://www.peoplegoal.com/blog/wp-content/uploads/2019/11/21.png)