Opting for the appropriate business bank account is vital when it comes to managing and expanding your business in the UK. This ensures a clear distinction between your business and personal finances, providing valuable insights into spending, robust accounting features, and various additional benefits. The most effective business bank accounts equip you with the necessary financial instruments for your everyday business activities. These tools range from efficiently managing cash flow and simplifying accounting transactions to ensuring the security of your funds. Discover the optimal business bank account tailored to your requirements among the leading high street banks and acclaimed online challenger banks in the UK.

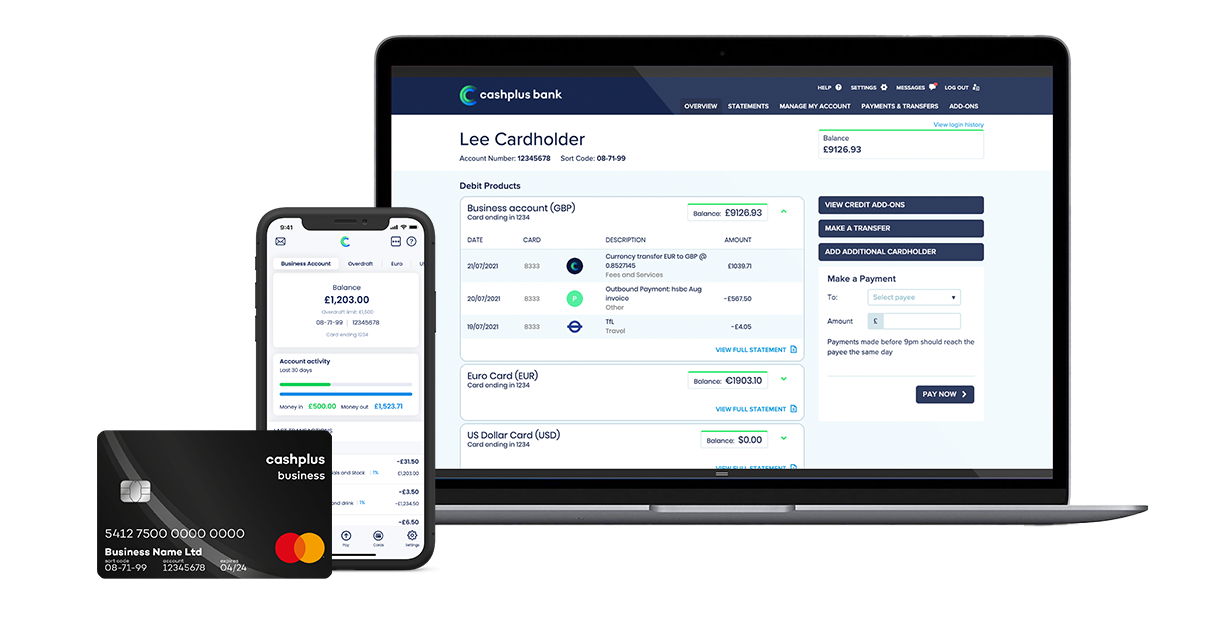

Why should organizations invest in business banking solutions?

Organizations should invest in business banking solutions for several compelling reasons. Firstly, a dedicated business bank account helps separate personal and business finances, providing clarity in financial transactions and simplifying accounting processes. These solutions often come with specialized features tailored for businesses, such as expense tracking, invoicing capabilities, and spending insights, promoting efficient financial management. Additionally, business banking solutions enhance security by safeguarding company funds, offering protection against fraud and unauthorized transactions. Choosing the right business banking solution can also lead to cost savings, as many providers offer competitive fee structures and reduced transaction costs for business-related activities. Overall, investing in a business banking solution is a strategic move that contributes to financial organization, security, and operational efficiency for businesses of all sizes.

List of the Best Business Banking Solutions in 2025:

- ANNA Money

- Automated Accounting and Bookkeeping

- Smart Financial Insights and Guidance

- Suited for Freelancers and Small Businesses

- Card One Money

- Efficient Expense Management

- Real-Time Account Access

- Customizable Spending Limits

- CashPlus

- Real-Time Expense Management

- Virtual Expense Cards

- Multi-Currency Accounts

List of the best business banking solutions:

- ANNA Money – Best for Freelancers and Small Businesses

- Card One Money – Best for Simple Business Banking Solutions

- CashPlus – Best for Efficient Expense Management

- HSBC Kinetic – Best for Established Businesses with International Operations

- Monzo – Best for Digital Natives and Tech-Savvy Entrepreneurs

- Revolut – Best for Global Businesses with Currency Needs

- Tide – Best for Small Businesses with Straightforward Banking Needs

Business Banking Solutions Comparison Table

| Software | Starting Price | Review Scores (According to Smart Money People) | Key Features |

|---|---|---|---|

| ANNA Money | Contact for Pricing | 4.8/5 | Automated Invoicing |

| Real-Time Expense Tracking | |||

| Personalized Financial Insights | |||

| Card One Money | $16 per month | 5/5 | User-Friendly Interface |

| Quick Account Setup | |||

| Transparent Fee Structure | |||

| CashPlus | $0 per month | 4.8/5 | Expense Tracking and Reporting |

| Prepaid Business Cards | |||

| Mobile App Accessibility | |||

| HSBC Kinetic | Free for first 12 months, then $8.3 | 4.7/5 | Global Business Accounts |

| per month | Integrated Banking Services | ||

| Advanced Security Measures | |||

| Monzo | $0 per month | 4.9/5 | Real-Time Expense Tracking |

| In-App Financial Management | |||

| Integrated Business Tools | |||

| Revolut | $0 per month | 4.7/5 | Multi-Currency Accounts |

| Real-Time Currency Exchange | |||

| Expense Management Tools | |||

| Tide | $0 per month | 4.8/5 | Straightforward Account Setup |

| Expense Management | |||

| Real-Time Notifications |

The research on business banking solutions involved a comprehensive approach to ensure a thorough evaluation of each option. The initial step included identifying a diverse range of high street and online challenger banks catering to businesses in the UK. Key features considered during this analysis encompassed monthly fees, available cards, deposit and withdrawal limits and fees, as well as the quality of customer support. The focus was on understanding the specific needs of different businesses, from freelancers to established enterprises, tailoring recommendations based on their requirements. The research involved a meticulous review of each provider’s offerings, user feedback, and industry expert insights to present a well-rounded guide on the best business banking solutions for various business types and sizes.

The exploration of business banking solutions aimed at highlighting the manifold benefits they offer to businesses. The research delved into understanding how these solutions contribute to the efficiency and financial well-being of businesses, emphasizing aspects like seamless day-to-day operations, enhanced cash flow management, and secure fund handling. Key features considered during the evaluation included the flexibility of monthly fees, the number of cards available, deposit and withdrawal limits and fees, and the responsiveness of customer support. The approach involved a meticulous examination of each business banking provider’s features, scrutinizing user reviews, and consulting industry insights to provide businesses with tailored recommendations based on their unique needs and preferences. The goal was to present a comprehensive guide that empowers businesses to make informed decisions about their banking solutions.

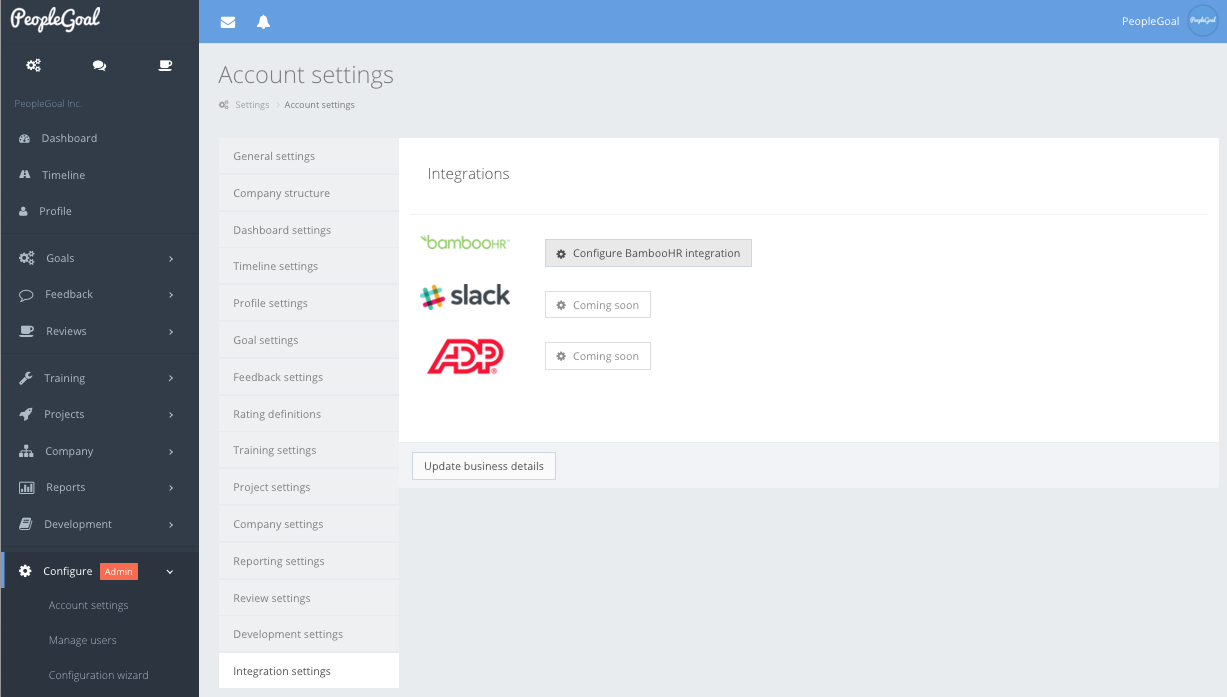

ANNA Money – Best for Freelancers and Small Businesses

ANNA Money, standing for Absolutely No-Nonsense Admin, is a pioneering business banking solution designed specifically for freelancers and small businesses. It prioritizes simplicity and efficiency, redefining the business banking experience. The platform offers a range of features that streamline financial operations, making it an ideal choice for those navigating the complexities of freelance and small business finances.

Key Features

- Automated Invoicing: ANNA Money facilitates automated invoicing, saving users time and ensuring a professional and timely invoicing process.

- Real-Time Expense Tracking: The platform offers real-time tracking of expenses, allowing users to stay on top of their financial transactions and manage budgets effectively.

- Personalized Financial Insights: ANNA Money provides personalized financial insights, empowering users with data-driven decision-making capabilities.

Benefits

- Time Efficiency: Automated administrative tasks save users time, allowing them to focus on core business activities.

- Enhanced Financial Visibility: Real-time expense tracking and personalized insights contribute to improved financial visibility, aiding in informed decision-making.

- All-in-One Banking Solution: ANNA Money serves as a comprehensive solution for various banking needs, consolidating financial management in one platform.

Pros

- Tailored for Freelancers and Small Businesses: ANNA Money is custom-designed for freelancers and small businesses, ensuring a targeted banking solution that meets their specific needs.

- Intuitive Interface: With a user-friendly design, ANNA Money caters to users with various levels of financial expertise, offering a seamless experience for small business owners managing their finances independently.

- Automated Financial Management: ANNA Money incorporates automation features such as invoicing and expense categorization, saving time and ensuring accurate financial records for users.

Cons

- Limited Market Focus: ANNA Money’s focus on freelancers and small businesses may limit its suitability for larger enterprises with more complex financial needs.

- Global Reach Limitations: The platform may have limitations for businesses engaged in international transactions, catering more to those operating within specific geographic regions.

- Cash Deposit Transaction Fees: ANNA Money imposes fees for cash deposits, impacting the cost-effectiveness of businesses heavily involved in cash transactions.

Pricing

ANNA Money business account has three pricing plans starting with ‘Pay As You Go’ which has no monthly fee but you pay for what you use. For more information, head to their website here.

Summary and Verdict

ANNA Money is an ideal banking solution for freelancers and small businesses, offering tailored features, a user-friendly interface, and automated financial management. The platform’s focus on automation streamlines financial management for its target audience. It is a great solution for those seeking simplicity, personalization, and automation in their banking processes. While perfect for simplicity and personalization, it may not be suitable for larger enterprises or those engaged in extensive global transactions. For its target audience, ANNA Money provides a compelling choice, but businesses with broader or more complex financial operations may need alternatives with wider capabilities.

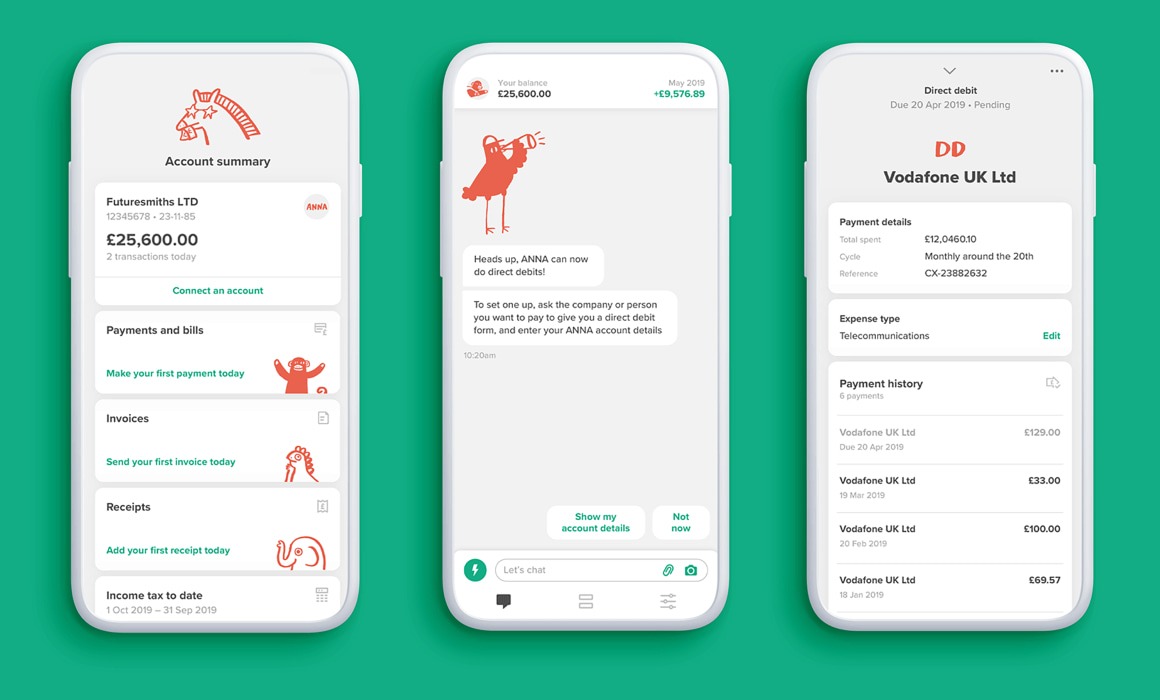

Card One Money – Best for Simple Business Banking Solutions

Card One Money is a leading business banking solution renowned for its simplicity and efficiency in catering to the needs of businesses, particularly those seeking straightforward banking solutions. With a commitment to providing simple business banking, Card One Money positions itself as a reliable partner for businesses that value ease of use and uncomplicated financial management. The platform strives to streamline banking processes, ensuring that businesses can focus on their core operations without navigating complex financial landscapes.

Key Features

- User-Friendly Interface: Card One Money boasts an intuitive and user-friendly interface, making it easy for businesses to manage their finances with minimal effort and complexity.

- Quick Account Setup: With a swift and straightforward account setup process, businesses can swiftly establish their banking presence without unnecessary delays.

- Transparent Fee Structure: Card One Money maintains a transparent fee structure, providing businesses with clarity on costs and ensuring they can budget effectively.

Benefits

- Effortless Financial Management: The simplicity of Card One Money’s platform allows businesses to manage their finances effortlessly, reducing the burden of complex banking procedures.

- Time-Efficient Operations: Businesses benefit from quick and easy account setup, saving valuable time that can be redirected towards core business activities.

- Cost Transparency: The transparent fee structure ensures that businesses have a clear understanding of their banking costs, contributing to better financial planning.

Pros

- Simplicity and Ease of Use: Card One Money excels in simplicity, providing businesses with an easy-to-use platform that doesn’t overwhelm users with unnecessary complexities.

- Quick Account Setup: The platform’s swift account setup process is a significant advantage, enabling businesses to establish their banking presence promptly.

- Transparent Fees: Card One Money’s commitment to transparent fees is a pro, ensuring businesses have a clear understanding of their financial commitments.

Cons

- Limited Advanced Features: While ideal for simplicity, businesses with more complex financial needs may find Card One Money lacking certain advanced features offered by other platforms.

- Limited International Features: For businesses engaged in extensive international transactions, Card One Money may have limitations, making it less suitable for global operations.

- Industry-Specific Solutions: Businesses in specific industries with unique banking requirements may find that Card One Money’s generalist approach doesn’t cater to their specialized needs.

Pricing

Card One Money charges $16 per month and has a $70 one-off application fee. For more information, contact Card One Money here.

Summary/Verdict

Card One Money shines as a business banking solution for those seeking simplicity and efficiency. With a user-friendly interface, quick setup, and transparent fees, it’s an excellent choice for small to medium-sized businesses looking for straightforward financial management. However, businesses with more complex financial needs, international operations, or industry-specific requirements may find alternatives better suited to their unique demands. Overall, Card One Money offers a solid solution for businesses valuing simplicity and ease of use in their banking operations.

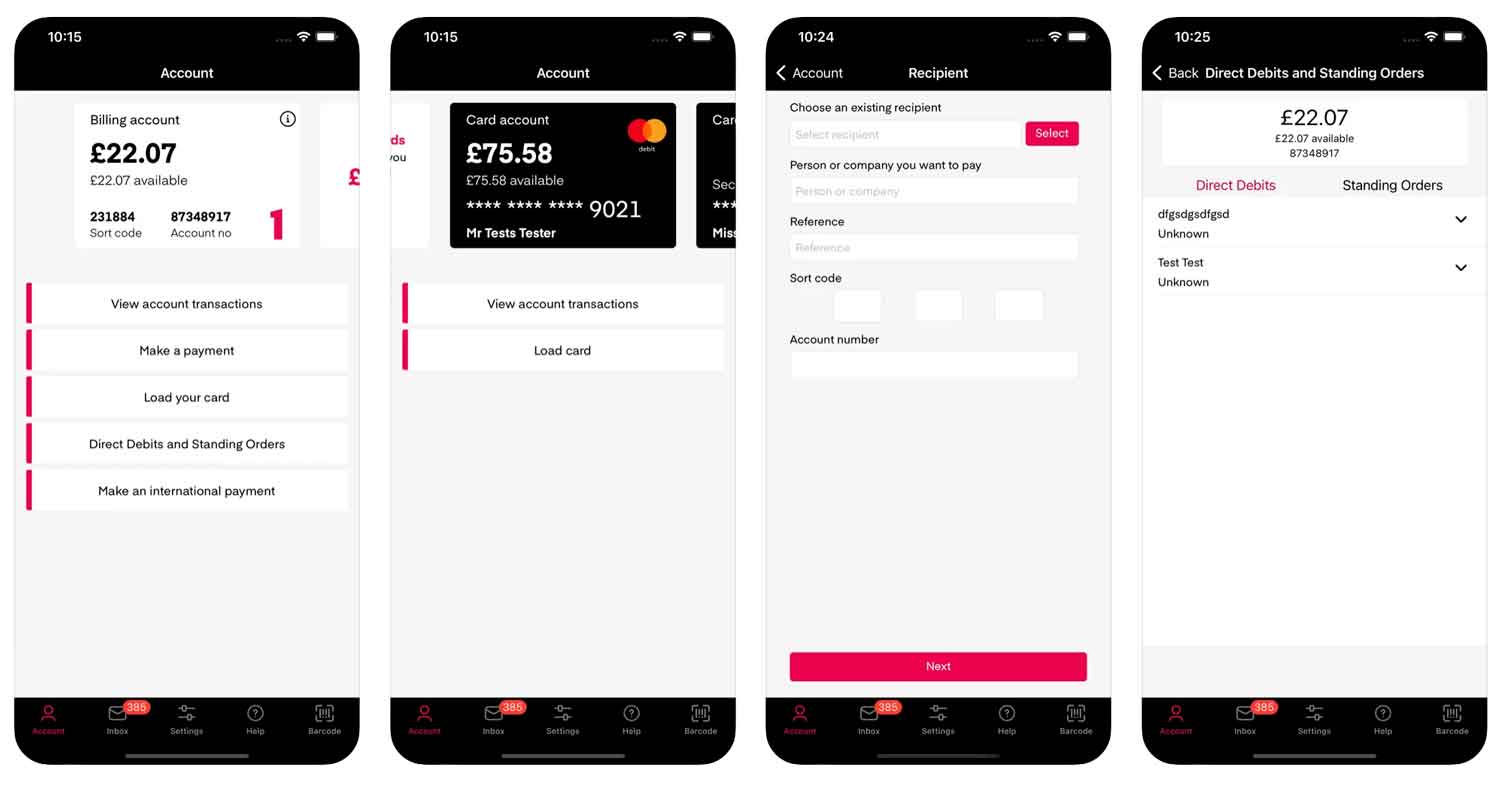

CashPlus – Best for Efficient Expense Management

CashPlus stands out as a business banking solution that excels in efficient expense management. Tailored for businesses of all sizes, CashPlus provides a comprehensive suite of financial tools designed to streamline expense tracking, enhance financial control, and optimize overall expense management processes. The platform aims to simplify the financial aspects of running a business, offering a user-friendly experience and robust features to ensure businesses have a reliable partner for their banking needs.

Key Features

- Expense Tracking and Reporting: CashPlus offers robust tools for tracking and reporting business expenses, facilitating real-time visibility into financial transactions and simplifying the reconciliation process.

- Prepaid Business Cards: The platform provides prepaid business cards, allowing businesses to manage and control employee spending effectively while eliminating the need for traditional credit facilities.

- Mobile App Accessibility: With a user-friendly mobile app, CashPlus enables businesses to manage their finances on the go, offering convenience and accessibility for users who need to stay connected to their financial data.

Benefits

- Streamlined Expense Management: CashPlus streamlines expense management processes, reducing the time and effort required for tracking, categorizing, and reconciling business expenses.

- Improved Financial Control: The platform enhances financial control by offering tools that empower businesses to set spending limits, monitor transactions, and prevent unauthorized expenditures.

- Convenient Accessibility: The mobile app ensures businesses have convenient access to their financial data anytime, anywhere, providing flexibility for users who need to manage finances on the move.

Pros

- Efficient Expense Tracking: CashPlus excels in providing efficient tools for tracking and managing business expenses, ensuring accuracy and transparency.

- Prepaid Business Cards: The availability of prepaid business cards enhances financial control, enabling businesses to manage employee spending more effectively.

- User-Friendly Mobile App: The user-friendly mobile app contributes to the platform’s accessibility, offering a seamless experience for businesses needing quick and convenient financial management.

Cons

- Limited International Capabilities: CashPlus may have limitations for businesses engaged in extensive international transactions, potentially impacting its suitability for globally operating companies.

- Transaction Fees: Some users may find that CashPlus imposes transaction fees, affecting the overall cost-effectiveness for businesses with high transaction volumes.

- Integration Challenges: Integrating CashPlus with other financial systems or software may pose challenges, particularly for businesses looking for seamless connectivity with existing tools.

Pricing

CashPlus offers a free plan with ‘Business Go’. For more information, contact CashPlus here.

Summary and Verdict

CashPlus is an excellent business banking solution, particularly for businesses focused on efficient expense management. Its emphasis on streamlined processes, prepaid business cards, and mobile app accessibility makes it an ideal choice for small to mid-sized enterprises seeking improved financial control. The platform’s limitations in international capabilities and potential transaction fees may be considerations for businesses with specific needs in those areas. Overall, CashPlus provides valuable tools for businesses aiming to simplify their expense management and enhance financial control. Businesses looking for a user-friendly and accessible solution for expense management will find CashPlus to be a compelling choice. However, those with extensive international operations or specific integration requirements may need to explore alternative solutions better suited to their needs.

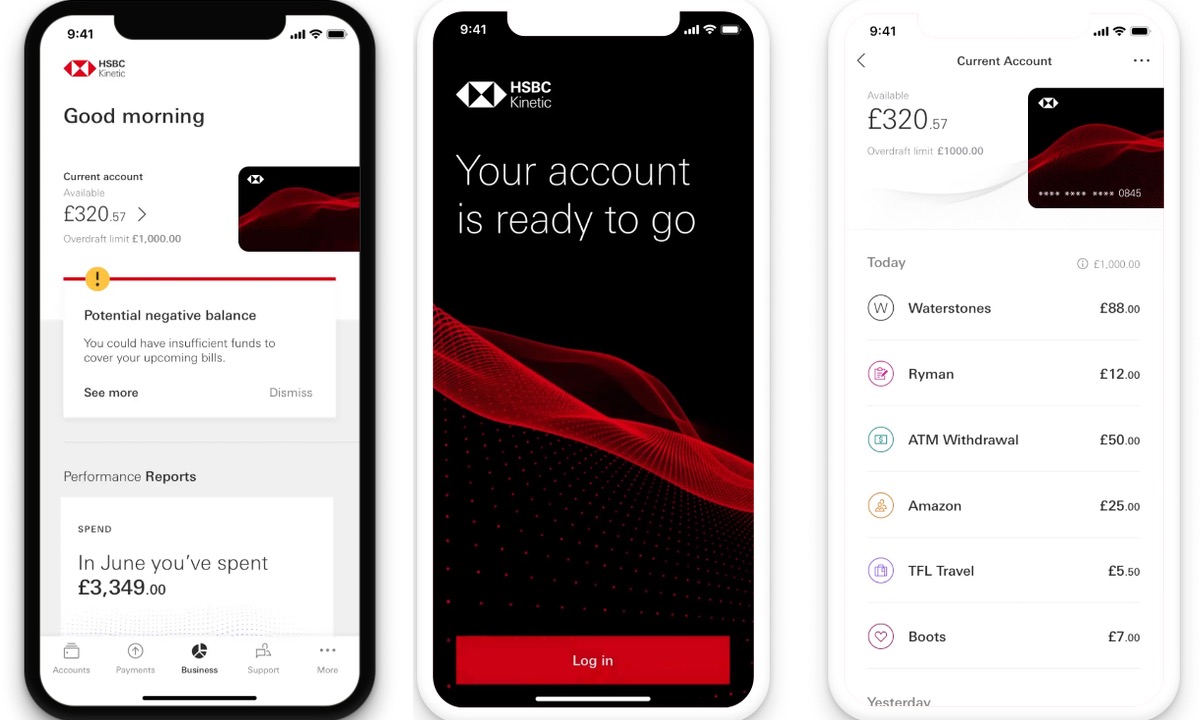

HSBC Kinetic – Best for Established Businesses with International Operations

HSBC Kinetic emerges as a robust business banking solution tailored for established businesses with international operations. As a distinguished player in the financial industry, HSBC Kinetic offers a comprehensive suite of banking services designed to meet the unique needs of businesses engaged in global activities. The platform facilitates seamless business banking, providing tools and features that contribute to efficient financial management, international transactions, and overall operational effectiveness. HSBC Kinetic positions itself as a reliable partner for businesses seeking sophisticated banking solutions in a global context.

Key Features

- Global Business Accounts: HSBC Kinetic offers global business accounts, providing businesses with the flexibility to manage their finances across multiple countries and currencies, simplifying international transactions.

- Integrated Banking Services: The platform integrates various banking services, including payment processing, invoicing, and account management, streamlining day-to-day financial activities for established businesses.

- Advanced Security Measures: HSBC Kinetic incorporates advanced security measures to safeguard business transactions and sensitive financial data, ensuring a secure banking environment for businesses with international exposure.

Benefits

- Efficient Global Transactions: HSBC Kinetic facilitates efficient global transactions, allowing businesses to manage payments, receivables, and other financial activities seamlessly across borders.

- Comprehensive Financial Management: The integrated banking services contribute to comprehensive financial management, offering businesses a centralized platform for various banking activities, enhancing operational efficiency.

- Enhanced Security: With advanced security measures, HSBC Kinetic prioritizes the protection of business transactions and sensitive financial information, providing businesses with a secure banking environment.

Pros

- Global Banking Expertise: HSBC Kinetic leverages the global banking expertise of HSBC, making it an ideal choice for businesses with international operations requiring a deep understanding of diverse financial landscapes.

- Integrated Services: The platform’s integration of various banking services provides a consolidated solution for businesses, minimizing the need for multiple banking tools and enhancing overall efficiency.

- Customizable Solutions: HSBC Kinetic offers customizable banking solutions, allowing businesses to tailor their banking experience based on their specific needs and preferences.

Cons

- Higher Fees for International Transactions: Some businesses may find that HSBC Kinetic imposes higher fees for international transactions, impacting the overall cost-effectiveness for companies with extensive global operations.

- Complex Onboarding Process: The onboarding process for HSBC Kinetic can be more complex compared to some other business banking solutions, potentially requiring additional time and documentation.

- Limited Accessibility for Small Businesses: While suitable for established businesses, HSBC Kinetic may have limited accessibility for smaller enterprises with less complex banking needs.

Pricing

HSBC Kinetic business accounts are free for the first 12 months from account opening then charges $8.3 per month. For more information, visit HSBC Kinetic here.

Summary/Verdict

HSBC Kinetic stands out as an exceptional business banking solution, particularly tailored for established businesses with international operations. With a focus on efficient global transactions, comprehensive financial management, and enhanced security, the platform aligns well with the needs of businesses navigating the complexities of the global marketplace. Its affiliation with HSBC brings a wealth of global banking expertise, making it an excellent choice for enterprises requiring a deep understanding of international financial landscapes. However, businesses should consider the higher fees for international transactions, the potentially complex onboarding process, and the platform’s limited accessibility for smaller enterprises. Overall, HSBC Kinetic is a great solution for established businesses seeking sophisticated and customizable banking solutions in a global context. Smaller enterprises or those with simpler banking needs might find more suitable alternatives offering a more straightforward onboarding process and cost-effective international transactions.

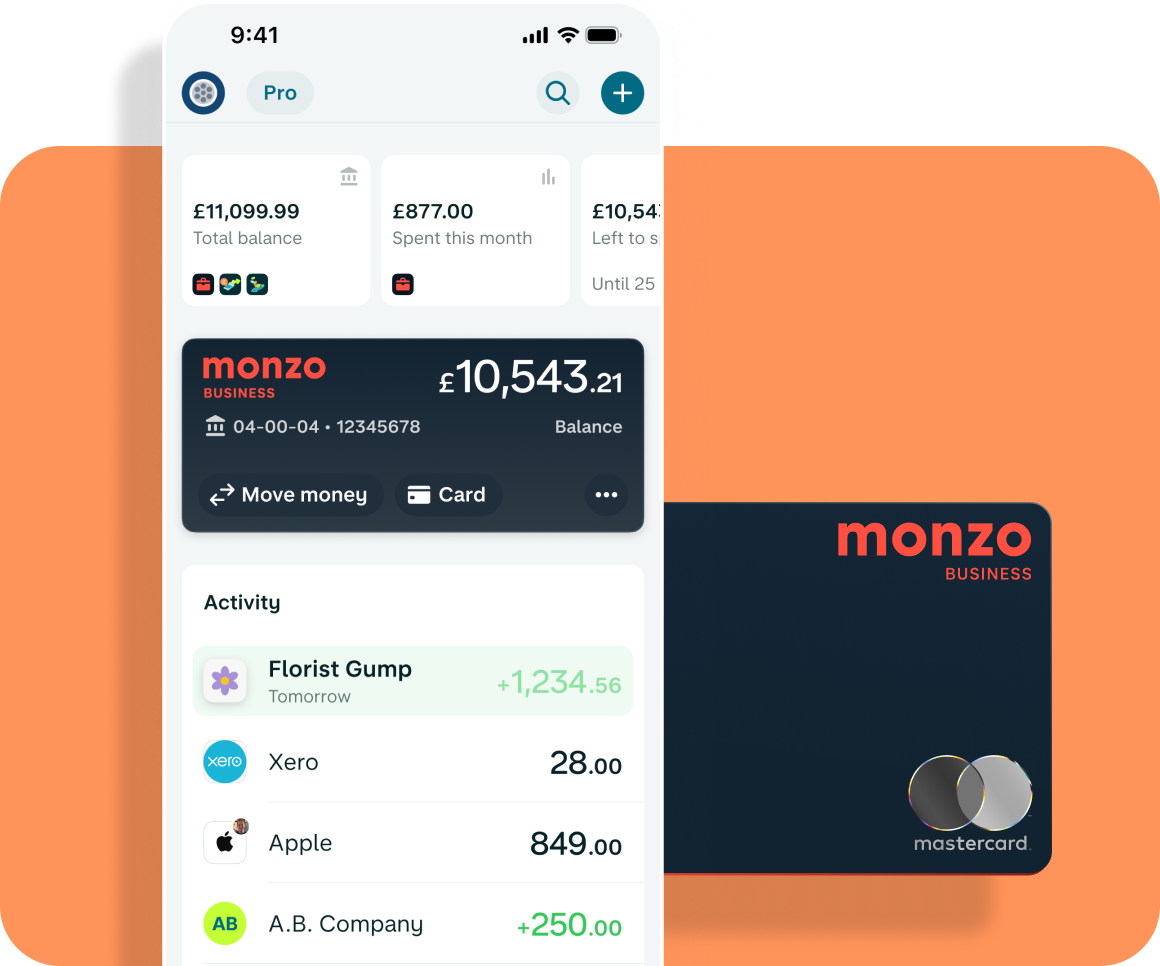

Monzo – Best for Digital Natives and Tech-Savvy Entrepreneurs

Monzo stands at the forefront of innovative business banking solutions, catering specifically to digital natives and tech-savvy entrepreneurs. As a leading digital bank, Monzo redefines the traditional banking experience by offering a suite of cutting-edge features tailored for those who thrive in the digital realm. The platform provides a seamless and intuitive business banking experience, allowing users to manage their finances effortlessly through a user-friendly mobile app. With a focus on simplicity, transparency, and real-time insights, Monzo positions itself as the go-to choice for businesses seeking a modern and tech-driven approach to financial management.

Key Features

- Real-Time Expense Tracking: Monzo excels in real-time expense tracking, providing businesses with instant insights into their spending patterns. This feature empowers entrepreneurs to make informed financial decisions on the go.

- In-App Financial Management: The platform offers a comprehensive in-app financial management toolkit, allowing users to categorize transactions, set budgets, and gain a holistic view of their business finances within the app.

- Integrated Business Tools: Monzo integrates essential business tools, including invoicing and receipt capture, directly into the app, streamlining administrative tasks for tech-savvy entrepreneurs.

Benefits

- Effortless Financial Monitoring: Monzo’s real-time expense tracking and in-app financial management tools make it easy for digital natives to monitor and control their business finances effortlessly.

- Simplified Administrative Tasks: The integration of business tools simplifies administrative tasks, enabling entrepreneurs to handle invoicing and receipt management seamlessly without the need for additional software.

- Enhanced User Experience: Monzo offers a user-friendly and intuitive mobile app, enhancing the overall user experience for those who prefer a streamlined, digital approach to business banking.

Pros

- Digital Native-Friendly: Monzo caters specifically to digital natives and tech-savvy entrepreneurs, providing a banking experience aligned with their preferences and expectations.

- Transparent Fee Structure: The platform maintains a transparent fee structure, ensuring users are aware of any charges, and there are no hidden fees that could impact their financial management.

- Quick and Easy Setup: Entrepreneurs can quickly set up their business account with Monzo, enjoying a hassle-free onboarding process that aligns with the fast-paced nature of digital businesses.

Cons

- Limited International Features: Monzo’s international features may be limited compared to some traditional banks, potentially posing challenges for businesses with extensive international operations.

- Business Loans Availability: Monzo’s business banking offering may lack certain financial products, such as business loans, which could be a limitation for businesses seeking comprehensive financial solutions.

- Relatively New in Business Banking: Monzo is relatively new in the business banking space, and businesses looking for a long-established banking partner might prefer alternatives with a more extensive track record.

Pricing

Monzo offers a free business plan with basic features. For more information, visit Monzo here.

Summary/Verdict

Monzo emerges as an ideal business banking solution for digital natives and tech-savvy entrepreneurs who prioritize a modern, digital-first approach to financial management. With real-time expense tracking, in-app financial management, and integrated business tools, Monzo simplifies the complexities of business finances for those who prefer the convenience of a mobile app. The platform’s transparent fee structure, quick setup process, and emphasis on user experience make it an excellent choice for businesses aligned with its digital-centric ethos. However, businesses with extensive international operations or those requiring specific financial products like business loans might find Monzo’s offerings somewhat limited. Overall, Monzo is a great solution for businesses seeking a fresh and innovative approach to business banking, but businesses with more diverse financial needs or those requiring extensive international features may explore alternatives with a more established presence in the business banking landscape.

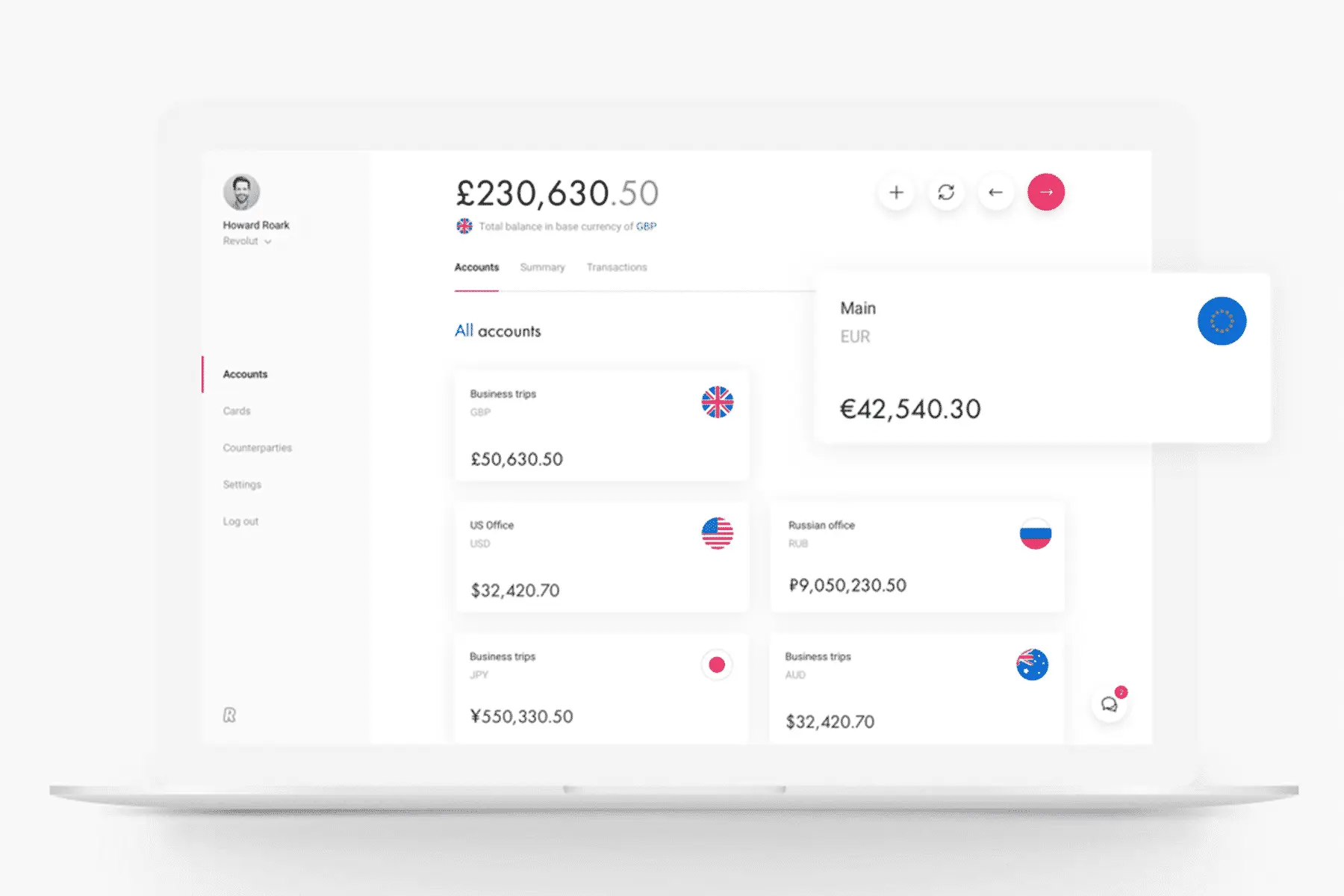

Revolut – Best for Global Businesses with Currency Needs

Revolut emerges as a trailblazer in the realm of business banking solutions, specializing in serving global businesses with diverse currency needs. Recognized for its disruptive approach, Revolut offers a comprehensive platform that transcends traditional banking boundaries. Designed to meet the complex financial requirements of global enterprises, Revolut provides a suite of tools and features that empower businesses to navigate international transactions seamlessly. With a commitment to transparency, cost efficiency, and cutting-edge technology, Revolut stands as a beacon for businesses seeking a modern and globally-minded banking solution.

Key Features

- Multi-Currency Accounts: Revolut’s standout feature lies in its multi-currency accounts, enabling businesses to hold and transact in multiple currencies. This flexibility is crucial for global enterprises dealing with diverse international markets.

- Real-Time Currency Exchange: The platform facilitates real-time currency exchange at interbank rates, empowering businesses to conduct international transactions with cost-effectiveness and transparency.

- Expense Management Tools: Revolut integrates robust expense management tools, allowing businesses to track and manage their spending across different currencies effortlessly.

Benefits

- Cost-Effective Currency Management: Revolut’s real-time currency exchange at interbank rates ensures that businesses can manage their currency needs cost-effectively, minimizing the impact of unfavorable exchange rates.

- Global Accessibility: With multi-currency accounts and efficient currency exchange, Revolut provides global businesses with the accessibility they need to operate seamlessly in diverse markets, eliminating barriers related to currency restrictions.

- Enhanced Financial Control: The expense management tools embedded in Revolut’s platform enhance financial control for businesses, enabling them to monitor and optimize spending across various currencies in real-time.

Pros

- Global Currency Flexibility: Revolut excels in providing businesses with the flexibility to transact and operate in multiple currencies, making it an excellent choice for enterprises with diverse international operations.

- Transparency in Currency Transactions: The platform’s commitment to real-time currency exchange at interbank rates ensures transparency in currency transactions, empowering businesses to make informed financial decisions.

- Innovative Technology Integration: Revolut’s innovative use of technology, including features like instant notifications and user-friendly mobile app interfaces, contributes to a modern and efficient business banking experience.

Cons

- Limited Banking Product Offerings: Revolut’s primary focus on currency management and international transactions may mean it lacks some traditional banking products, potentially limiting its appeal for businesses seeking a comprehensive suite of financial solutions.

- Customer Support Concerns: Some users have reported concerns about Revolut’s customer support response times, which could be a drawback for businesses requiring immediate assistance for urgent matters.

- Regulatory Challenges: Being a fintech disruptor, Revolut may face regulatory challenges in certain regions, potentially affecting its ability to offer services or features in specific markets.

Pricing

Revolut offers a free business plan with basic features. For more information, visit Revolut here.

Summary/Verdict

Revolut stands as an unparalleled solution for global businesses with intricate currency needs, offering a platform that transcends traditional banking limitations. With its multi-currency accounts, real-time currency exchange, and robust expense management tools, Revolut provides businesses with the tools they need to navigate the complexities of international transactions seamlessly. The platform’s commitment to transparency, cost efficiency, and innovative technology integration makes it an excellent choice for enterprises operating on a global scale. However, businesses seeking a more traditional suite of banking products or those prioritizing immediate customer support may find alternatives better suited to their needs. In summary, Revolut is an outstanding choice for businesses immersed in the global marketplace, leveraging its advanced currency management features, but those with diverse financial needs or requiring extensive customer support may explore alternatives for a more comprehensive solution.

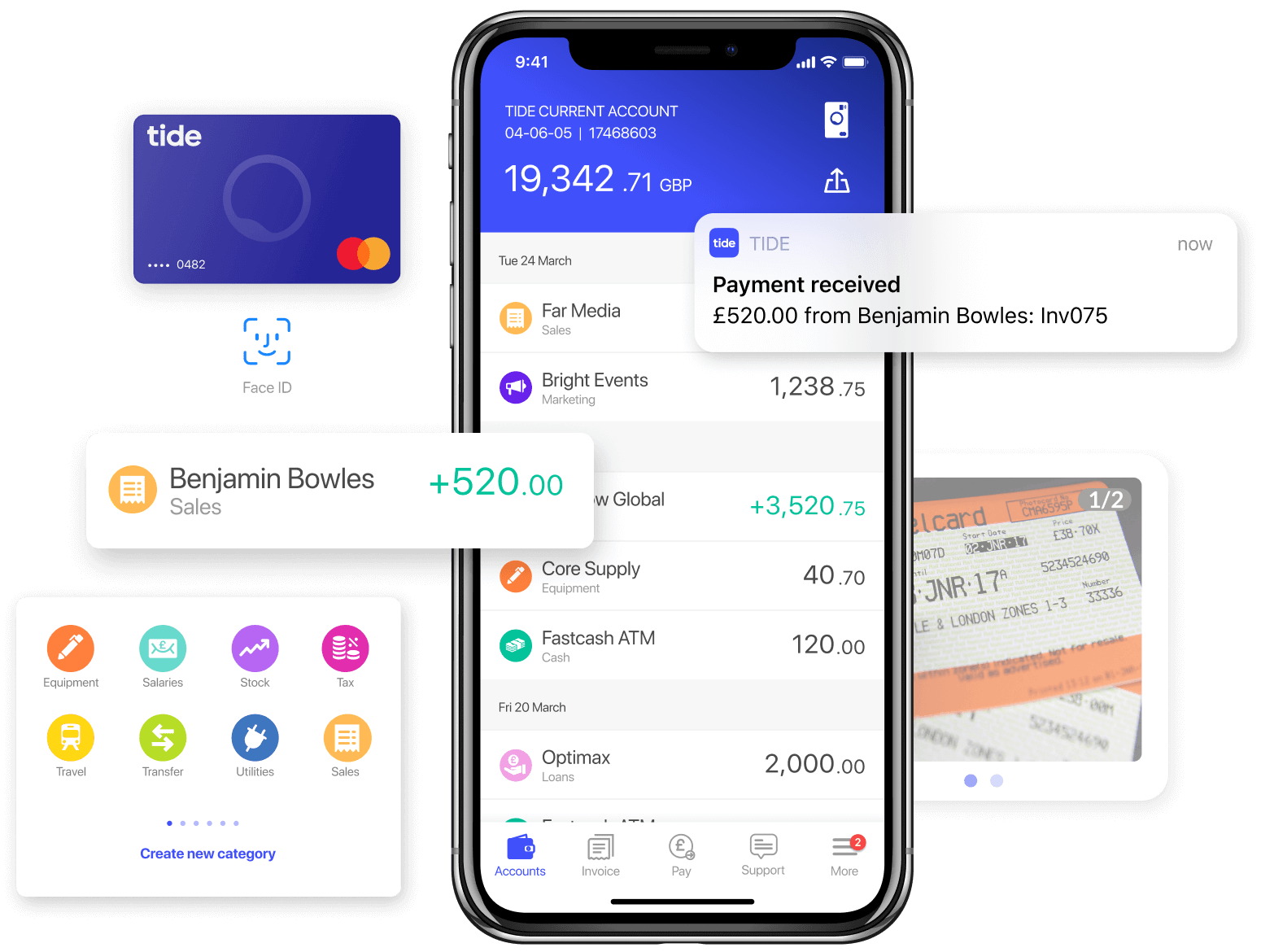

Tide – Best for Small Businesses with Straightforward Banking Needs

Tide, a standout player in business banking solutions, caters specifically to the needs of small businesses with straightforward banking requirements. Tailored for simplicity and efficiency, Tide positions itself as an ally for entrepreneurs seeking hassle-free banking experiences. The company’s commitment to empowering small businesses is evident in its user-friendly platform, providing a seamless interface for essential banking operations. Tide’s approach revolves around eliminating unnecessary complexities, making it an ideal banking solution for small businesses aiming for streamlined financial management without unnecessary frills.

Key Features

- Straightforward Account Setup: Tide excels in offering a hassle-free account setup process, allowing small businesses to establish a banking presence swiftly and efficiently.

- Expense Management: The platform integrates robust expense management tools, empowering small businesses to track and manage their spending with ease.

- Real-Time Notifications: Tide stands out with its real-time notifications, ensuring businesses stay informed about their financial transactions promptly, enhancing control and oversight.

Benefits

- Time-Efficient Onboarding: Tide’s straightforward account setup process translates into time efficiency for small businesses, enabling them to focus on core operations rather than navigating complex banking procedures.

- Cost-Effective Banking: With a focus on essential features, Tide provides cost-effective banking solutions for small businesses, eliminating unnecessary fees and charges commonly associated with more extensive banking services.

- Enhanced Financial Control: The real-time notifications and expense management tools contribute to enhanced financial control, allowing small businesses to monitor their finances actively and make informed decisions.

Pros

- Tailored for Small Businesses: Tide’s explicit focus on the needs of small businesses makes it an ideal solution for entrepreneurs looking for a banking partner that understands and caters to their unique requirements.

- User-Friendly Interface: The platform’s user-friendly interface ensures that even businesses with limited financial expertise can navigate and leverage its features effortlessly.

- Transparent Fee Structure: Tide adopts a transparent fee structure, enabling small businesses to understand and manage their costs effectively without unexpected charges.

Cons

- Limited Advanced Features: Tide’s simplicity may result in limited advanced features, potentially making it less suitable for larger enterprises with more complex financial needs.

- Scope for Feature Expansion: While ideal for straightforward banking needs, Tide may have limited features for businesses seeking more comprehensive financial services beyond basic banking.

- Customer Support Concerns: Some users have reported concerns about customer support response times, potentially posing challenges for businesses requiring immediate assistance.

Pricing

Tide offers a free business plan with basic features. For more information and to request a quote, visit Tide here.

Summary/Verdict

Tide emerges as an excellent business banking solution, particularly tailored for small businesses with straightforward banking needs. Its user-friendly interface, time-efficient onboarding, and transparent fee structure make it an ideal choice for entrepreneurs seeking simplicity and efficiency in financial management. Small businesses benefit from Tide’s cost-effective banking, enhanced financial control, and a platform that understands and caters to their unique requirements. However, businesses with more intricate financial needs or those seeking advanced features may find alternatives better suited to their demands. In summary, Tide is a commendable choice for small businesses prioritizing simplicity and efficiency in their banking operations, while larger enterprises or those with complex financial requirements may explore alternative solutions for a more comprehensive banking experience.

Ready to 3x Your Teams' Performance?

Use the best performance management software to align goals, track progress, and boost employee engagement.

![Top 10+ HRIS Systems for 2025: The Ultimate HRIS Guide [Updated]](/blog/wp-content/uploads/ct/images.ctfassets.net/6g4s9n00xmsl/3HmuzpDff5SAoWQ6oI3VY3/c4bf806e7d3567dc7618947ea4e025e1/The_benefits_of_HRIS_software.png)